Tencent’s AI Paradox: Building a Lifeboat While Owning the Ark

Why China’s social media giant is spending billions on a separate AI app instead of transforming its 1.4-billion-user super-app?

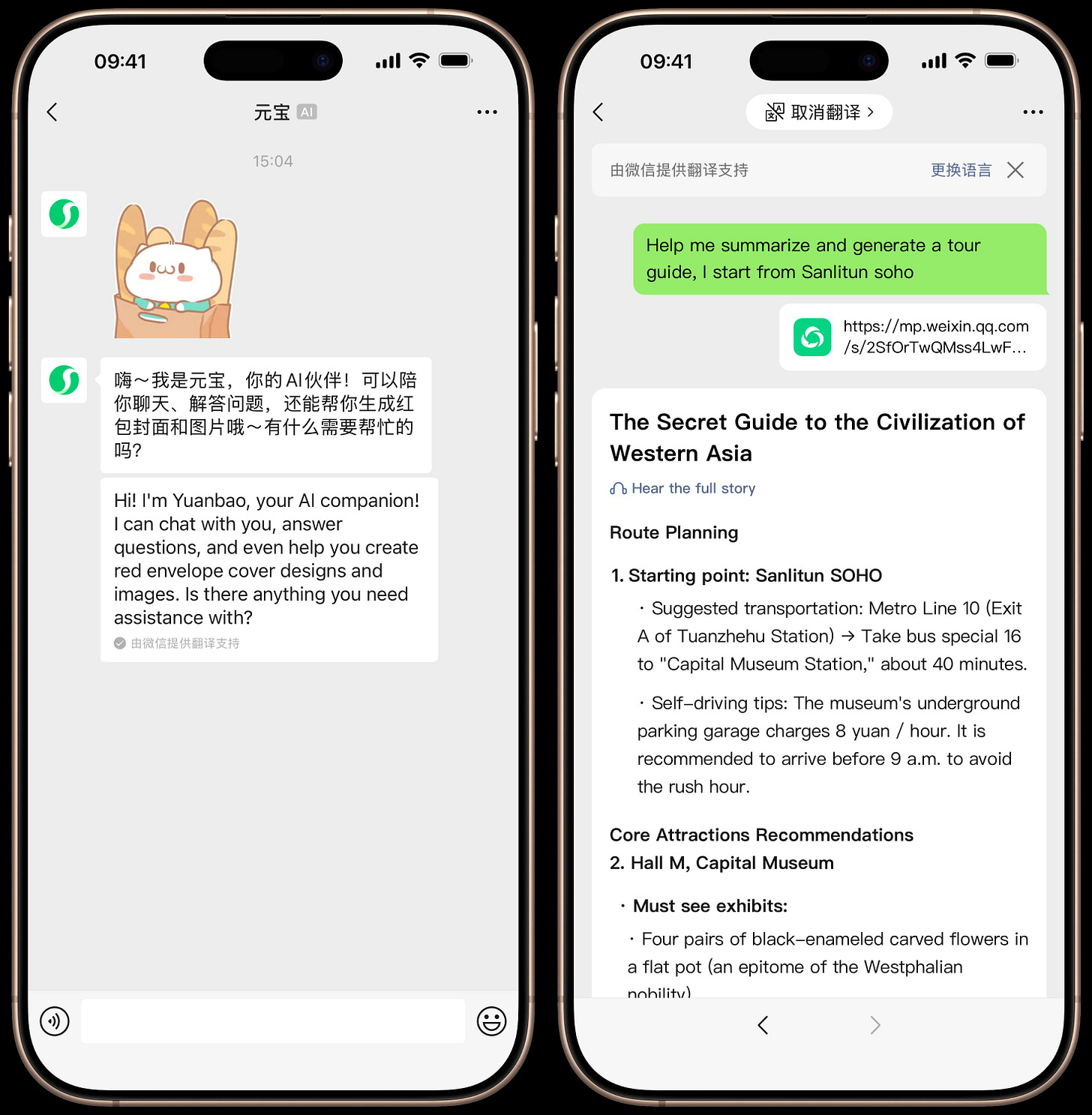

For millions of Chinese users, a new guest has appeared in the bustling comment sections of WeChat. It’s an uninvited but helpful presence, an AI bot named “Yuanbao” that materializes with a simple ‘@’ command to summarize articles. This small robot, popping up in China’s digital town square, is the tip of a multi-billion dollar spear. It represents Tencent’s frantic, and perhaps paradoxical, race to secure its dominance in the AI era.

The Chinese social media and gaming giant, which owns the 1.4-billion-user super-app WeChat, is spending on a scale that signals deep urgency. Yet, its strategy is not to transform its flagship product–the digital equivalent of a fortified ark. Instead, it is pouring resources into building a separate lifeboat, Yuanbao, and then forcing its entire ecosystem to tow it.

This high-stakes gamble reveals a profound anxiety at the heart of an empire: even for a company that owns the ultimate digital territory, the generative AI revolution feels like an existential threat, and its greatest weapon might be the one it’s most afraid to use.

The AI Arms Race: A Chasm of Capital and Users

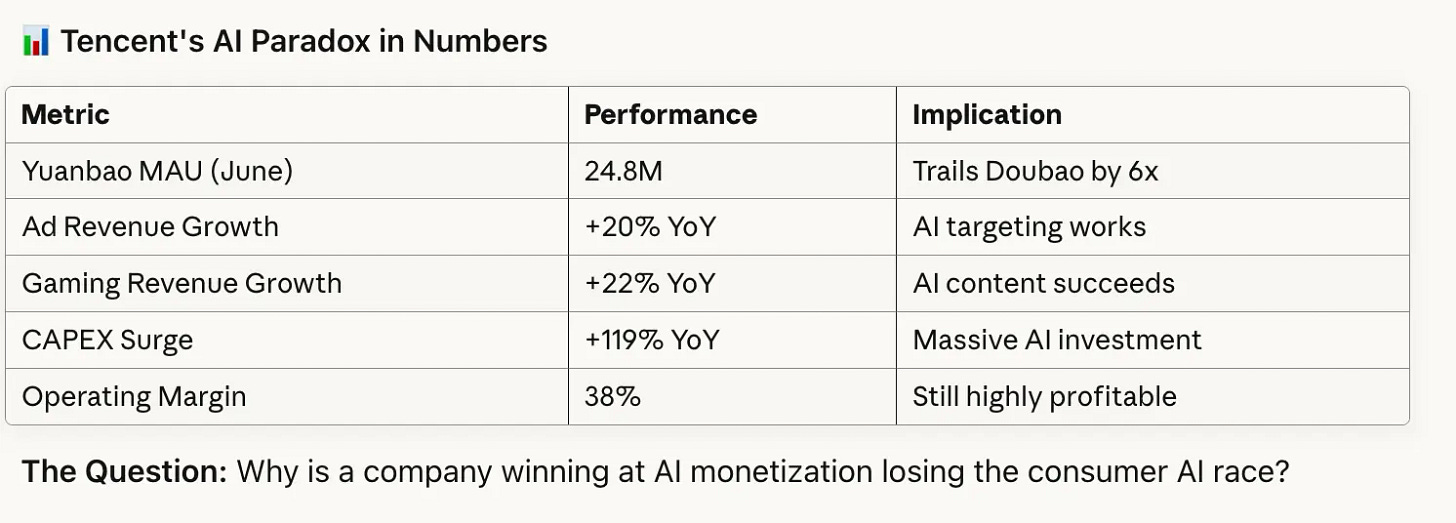

Tencent’s shift from cautious observer to aggressive combatant has been abrupt and expensive. In a clear signal to markets, its capital expenditure surged 119% year-on-year to ¥19.1 billion ($2.7 billion) in a single quarter, almost entirely for AI infrastructure. The investment is already paying dividends, with AI-driven ad tech boosting marketing revenues by 20% and gaming revenues by 22%, while pushing operating margins to an impressive 38%.

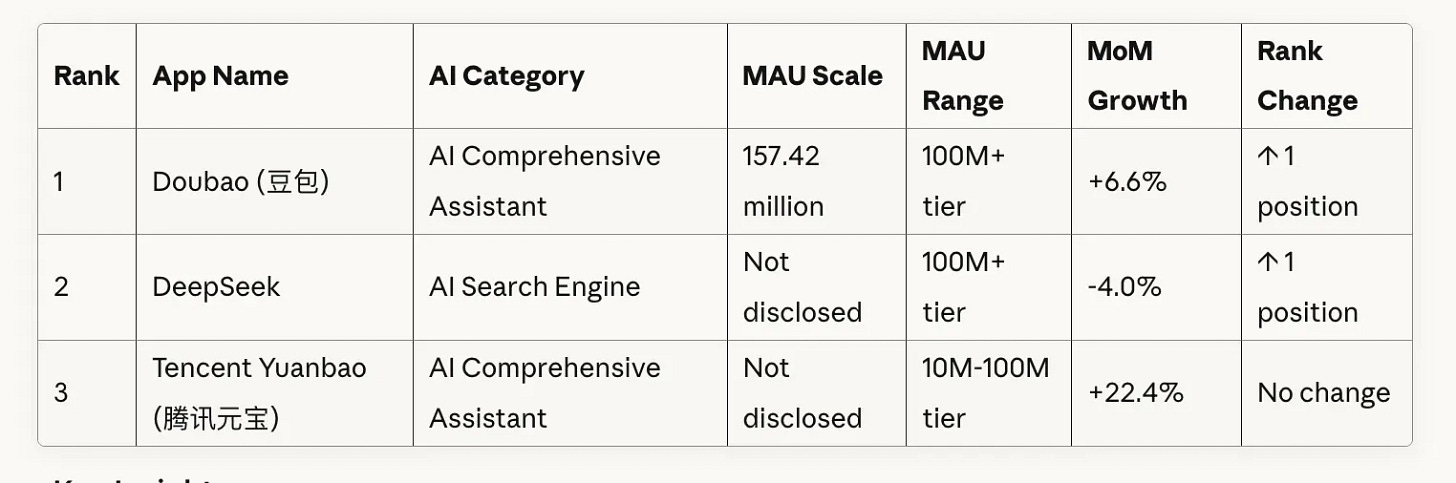

But these financial gains mask a stark reality on the most critical battlefield: AI-native applications. Here, Tencent is playing a desperate game of catch-up. The market leader is Doubao, an app from arch-rival ByteDance, which boasted a staggering 157 million monthly active users (MAU) in August.

Tencent’s Yuanbao, by comparison, had 24.8 million MAU in June–the last month for which precise figures are available. While the company reported strong month-on-month growth of 22.4% through August, even optimistic projections place Yuanbao in the “tens of millions” range, a five-to-six-fold deficit against its rival. This is not a gap; it is a chasm. The vast deficit, despite the billions spent, raises a profound question about Tencent’s strategy.

In response, the company has deployed a campaign of brute-force integration, a tactic that runs counter to its famous philosophy of letting products grow organically. “Top management is personally getting involved to attract the very best AI talent,” Tang Daosheng, CEO of Tencent’s Cloud and Smart Industries Group (CSIG), recently admitted.

This top-down push is visible everywhere. Yuanbao has been injected into every corner of the ecosystem–a button in WeChat’s search, an assistant in Tencent Docs, a chatbot that can be added as a friend. This aggressive integration has earned praise from some analysts. Morgan Stanley labels Tencent the “best practitioner of 2C AI applications,” while Forrester commends its pragmatic focus on turning concepts into measurable productivity. But the strategy is fundamentally a reaction to a rival that is winning not just with traffic, but with a more native approach to AI.

Yet here’s the puzzle that makes this race so fascinating: Tencent is simultaneously winning and losing at AI. The same quarter that saw Yuanbao trail far behind Doubao also delivered record margins and accelerating growth across its core businesses–all powered by AI working behind the scenes. This isn’t failure. It’s something stranger: a company succeeding at AI monetization while losing the consumer AI battle. And that success may be precisely why it can’t transform WeChat.

The WeChat Dilemma: The Empire’s Gilded Cage

The frantic activity around Yuanbao begs the question: why not unleash the ultimate weapon? Tencent President Martin Lau has sketched out the vision: an AI agent acting as a “personalized private assistant,” deeply integrated with a user’s social graph, content feeds, and the vast Mini Program ecosystem. But this vision is paralyzed by a set of deep, structural fears that make direct intervention in WeChat a near-impossible move.

The most obvious reasons are risk to user experience and privacy. But the true paralysis stems from far deeper conflicts.

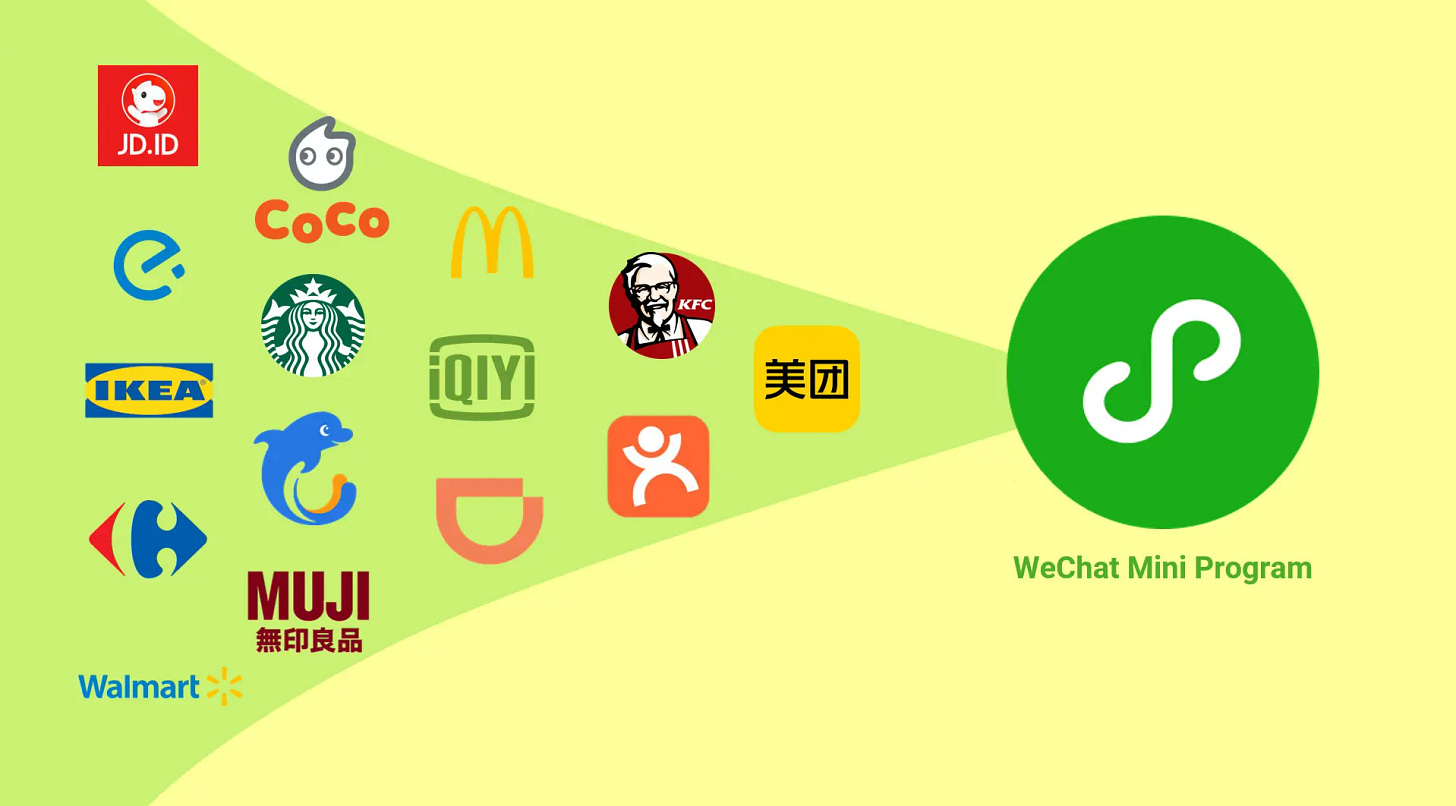

First is the threat to its business model. WeChat’s commercial power comes from its Mini Program ecosystem, a walled garden of millions of apps where Tencent acts as landlord and toll collector. A powerful, conversational AI that can directly fulfill user requests–“find and book me the cheapest flight to Shanghai”–could bypass this ecosystem entirely, disintermediating the very businesses that pay Tencent for access and traffic.

Second is a clash of organizational philosophy. The WeChat team’s product gospel is one of restraint and user-centric minimalism. It is a passive tool that waits for user commands. Generative AI, by its nature, is proactive and interventionist. Integrating a truly powerful AI would require a fundamental betrayal of the product creed that made WeChat successful, a cultural hurdle that may be insurmountable for its famously independent development team.

Finally, there is the unblinking eye of Beijing’s regulators. An AI integrated into a platform with 1.4 billion users would become the most powerful content generation and information distribution system in the country’s history. The potential for misuse, and the corresponding regulatory burden for content moderation and data security, would be immense. For Tencent, the risk of becoming an even bigger target for regulatory scrutiny may outweigh any potential reward. WeChat is not just an app; it is a piece of national digital infrastructure, and its stability is paramount.

Facing a Rival Where AI is the Product

This internal paralysis is all the more dangerous because Tencent faces a rival whose very DNA is algorithmic. ByteDance’s success with Doubao is not an accident of traffic; it is the natural evolution of its core identity. For ByteDance, the AI is the product. Its decade of perfecting the recommendation engines for TikTok and Douyin was a masterclass in using algorithms to understand and shape user behavior. The leap from a recommendation AI to a generative AI is a short and logical one.

For Tencent, AI is an add-on. Its core product, WeChat, is a social connection tool, a digital utility. While its technology is world-class–its Hunyuan models excel in global benchmarks for translation and reasoning–its integration is an overlay, not the essence of the product.

This fundamental difference explains ByteDance’s agility and market resonance. It has weaponized its algorithmic-native culture with a disruptive price war and flawless ecosystem synergy, creating a lead that Tencent’s brute-force traffic strategy has so far failed to dent. While Wall Street rightly identifies Tencent’s consumer focus as its strength, it is in a race against a competitor for whom the consumer and the algorithm are one and the same.

The Other Side of the Story

While Tencent trails in consumer AI apps, its backend AI infrastructure generated billions in incremental revenue last quarter. Ad targeting improved conversion rates by double digits. Gaming content generation extended product lifecycles. Cloud GPU rentals created new revenue streams.

This commercial success creates a deeper strategic dilemma: why risk disrupting a money-printing machine? The answer involves market structure, organizational culture, and long-term competitive positioning.

👉 For Premium subscribers: Read my deep-dive analysis of how Tencent is actually winning the AI monetization game–and why that makes the WeChat dilemma harder to solve: “Turning CAPEX into Cash: Tencent’s Template for AI Monetization”

Not a subscriber? Learn more about Premium benefits

A Rehearsal for a Future It Can’t Avoid

Tencent’s awkward and expensive push for Yuanbao is more than just a battle for a new app; it is a live rehearsal for a future it cannot avoid. Its struggles offer a critical lesson for platform giants globally: how do you integrate a disruptive technology into a stable, beloved ecosystem without breaking it?

The billions being spent on Yuanbao, the frantic ecosystem integration, the top-down management push–all signal that Tencent understands the stakes. But understanding and acting are different challenges entirely. The company can see the transformation coming but remains paralyzed by the risk of disrupting what already works extraordinarily well.

A Shanghai-based investor, in a recent interview with China Entrepreneur magazine, offered a compelling take on Tencent’s defensive strength. AI could disrupt content platforms like TikTok, he argued, but WeChat occupies a different category entirely. “Besides birth, sickness, old age, and death,” he said, “no one and no technology will stop you from contacting people on WeChat.”

The Profitability Paradox

This brings us to the most uncomfortable question: Is Tencent’s AI dilemma actually a problem?

From a pure financial perspective, the answer might be no. Tencent has demonstrated that AI can generate substantial returns through backend optimization alone–improving ad targeting, extending gaming lifecycles, and creating new cloud revenue streams–all without the risks of consumer-facing transformation. The template it has created might actually be more sustainable than the “AI-first” approaches of its rivals.

Rather than betting everything on a conversational interface that might or might not become the dominant paradigm, Tencent is extracting measurable value from AI across its existing business lines. Ad targeting improvements compound through network effects. Gaming content generation scales without proportional cost increases. Cloud services monetize both internal capabilities and external demand. Every quarter brings proof that this approach works financially.

But profitability in the present doesn’t guarantee relevance in the future. ByteDance isn’t building Doubao to compete with Tencent’s ad tech. It’s building the interface through which the next generation will interact with digital services. If conversational AI becomes the primary mode of human-computer interaction–as OpenAI, Google, and now ByteDance are betting–then WeChat’s current dominance could erode gradually, then suddenly.

The Shanghai investor was right: no technology will stop people from contacting each other on WeChat. But what if people increasingly start their digital journey with an AI agent that can access WeChat on their behalf, rather than opening WeChat first? The question isn’t whether WeChat will die–it’s whether it will remain the center of gravity.

Consider the parallel to Google’s search dominance. For years, observers noted that while social media and apps might chip away at search volume, people would always need to find information. Then ChatGPT demonstrated that conversational interfaces could handle many search queries more naturally. Google’s traffic hasn’t collapsed, but the strategic threat became undeniable. Tencent faces a similar inflection: not immediate displacement, but gradual marginalization as AI agents become the primary interface layer.

Tencent’s challenge, then, is not choosing between profitability and innovation. It’s deciding whether today’s cash flow justifies tomorrow’s strategic risk. The billions flowing from backend AI capabilities provide comfort, but they may also breed complacency. Every quarter of strong earnings makes the case for transformation a little harder to make internally. Every new user that ByteDance’s Doubao attracts makes the competitive threat a little more concrete.

And that is a question no amount of quarterly revenue growth can answer.

For Premium subscribers: My previous analysis examines the specific mechanisms behind Tencent’s AI monetization–from advertising conversion improvements to gaming content generation economics–and why these successes may paradoxically make WeChat transformation harder. The financial story explains how Tencent is winning today. This strategic analysis explains why winning today might mean losing tomorrow.

Read the full financial breakdown: “Turning CAPEX into Cash: Tencent’s Template for AI Monetization”

What This Means for Platform Giants Globally

Tencent’s struggle offers critical lessons for platform companies worldwide grappling with AI integration. The fundamental tension isn’t unique to Chinese tech–it’s universal to any company that owns a massive, successful user platform and must decide whether to risk disrupting it.

Meta faces similar calculations with Facebook and Instagram. Should it integrate Meta AI as a central feature, potentially disrupting the social graph mechanics that generate billions in advertising revenue? Google confronts the same dilemma with Search, where conversational AI might cannibalize the lucrative ad placement model that funds the company.

The difference is that Western platforms face less algorithmic competition. There is no Western equivalent to ByteDance–a company whose entire business model is built on algorithmic content distribution and whose leap to conversational AI feels inevitable rather than forced. This competitive pressure forces Tencent into uncomfortable choices that its Western counterparts can still postpone.

Tencent’s approach–building a separate AI product while gradually embedding AI into core platforms–may become the template others follow. It provides optionality: if Yuanbao succeeds, it becomes the new growth engine. If it fails, the backend AI capabilities continue generating returns. The downside is strategic drift–neither fully committing to AI-first transformation nor maintaining focus on core platform strengths.

The ultimate question for all platform giants is whether gradual AI integration can match the pace of AI-native challengers. Tencent’s billions in spending and impressive monetization metrics suggest it can compete on technology. Whether it can compete on user behavior change–the deeper challenge ByteDance poses–remains the open question.

Conclusion: Courage or Complacency?

WeChat’s dominance in social connectivity remains unassailable—but that invincibility is precisely what creates Tencent’s strategic trap. The company has proven it can monetize AI brilliantly through infrastructure-layer optimization, delivering results that Western platforms are still struggling to achieve. Yet as global analysts concluded, Tencent’s destiny is not to be China’s AI infrastructure leader—that role belongs to Alibaba. Its destiny is to be the country’s “best practitioner of consumer AI.”

To fulfill that destiny, it must eventually infuse its ultimate consumer product with its best AI. The question is no longer whether it can, but whether today’s profitability will give it the courage–or the complacency–to open its own gilded cage.

The answer will determine not just Tencent’s future, but potentially the template for how all platform giants navigate the transition to AI-mediated interaction. For now, the company continues its awkward dance: building around its greatest asset rather than building within it, spending billions on a separate future rather than risking the present.

It is a strategy born of caution, executed with urgency, and funded by profits. Whether it proves brilliant or tragic will depend on whether the AI revolution moves faster than Tencent’s ability to hedge its bets.

WeChat will succeed.

Because users tend to enter WeChat first for anything they may have interest with their own personal opinion and preference without hesitation before seeking for Yuanbao AI assistance.

.

Yuanbao AI assistant will not interrupt WeChat in any areas but to enhance.

.

The management behind WeChat are smart elite.