Turning CAPEX into Cash: Tencent’s Template for AI Monetization

Q2 2025 proves Tencent’s AI spend drives results: higher ad yield, longer game lifecycles, and cloud monetization—while margins hold. The paid section details the playbook and metrics.

Hello China Tech by Poe Zhao -- Essential insights into China's tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each week features in-depth free analysis plus premium insights for subscribers who need comprehensive coverage of China's strategic tech developments and their worldwide implications.

Limited-time offer: Upgrade to premium for 3x weekly strategic insights and market analysis. Regular pricing is $15/month, but subscribe before September 1st to lock in permanent discount pricing at just $10/month or $100/year.

When Mark Zuckerberg declared 2023 the “Year of Efficiency” after burning billions on the metaverse, investors breathed a collective sigh of relief. The spending spree was over; the focus would shift to profitable AI applications. Now, watching Tencent’s Q2 2025 results, global investors might be witnessing something equally significant—but in reverse. This isn’t a company pulling back from massive AI investments. This is a company proving those investments actually work.

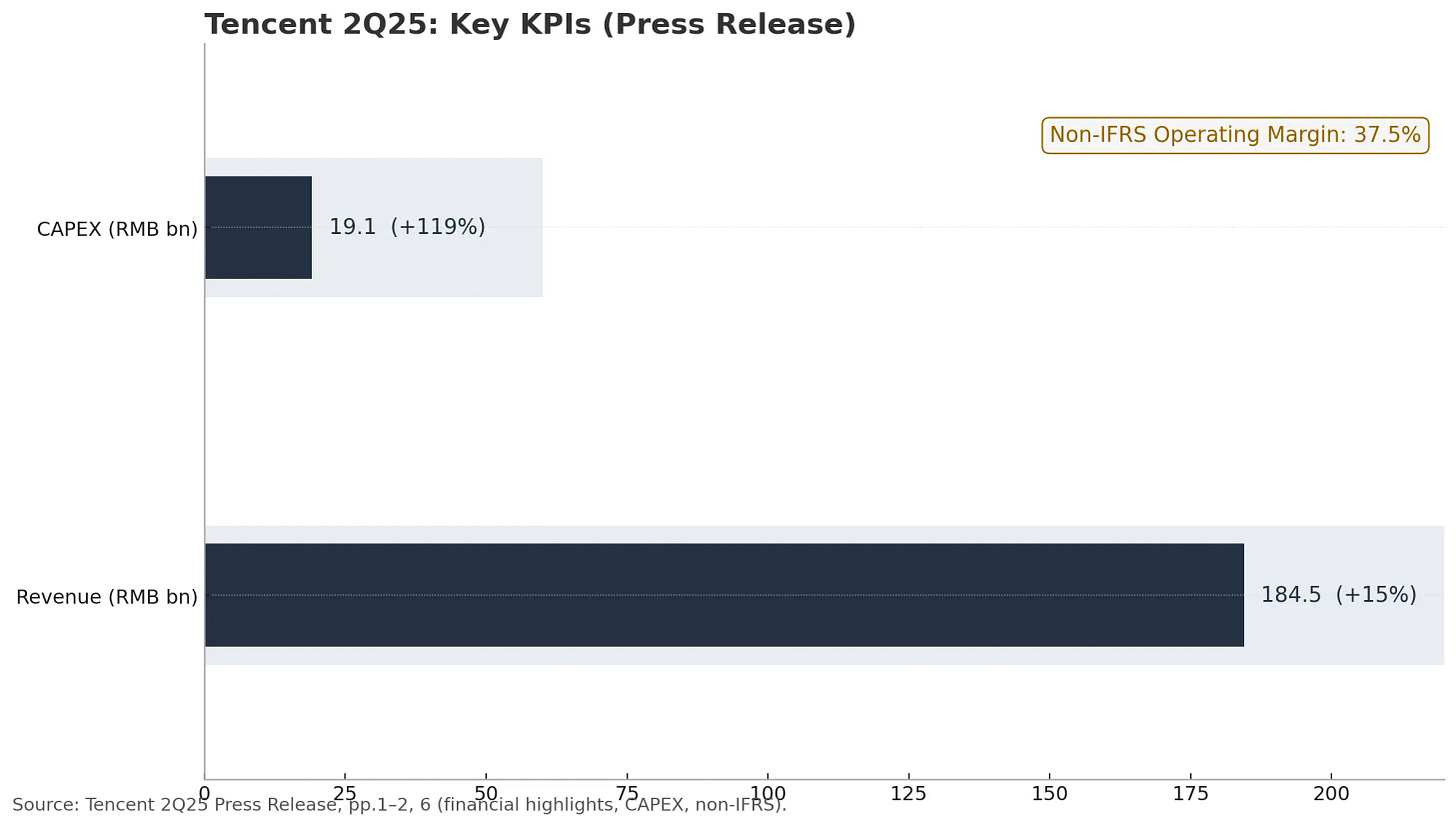

The numbers tell a remarkable story. Revenue jumped 15% year-over-year to RMB 184.5 billion, while operating margins expanded to 38%—all despite capital expenditure doubling to RMB 19.1 billion.

This represents something Western tech investors have been waiting to see—clear evidence that AI spending translates into business results, not just impressive demos.

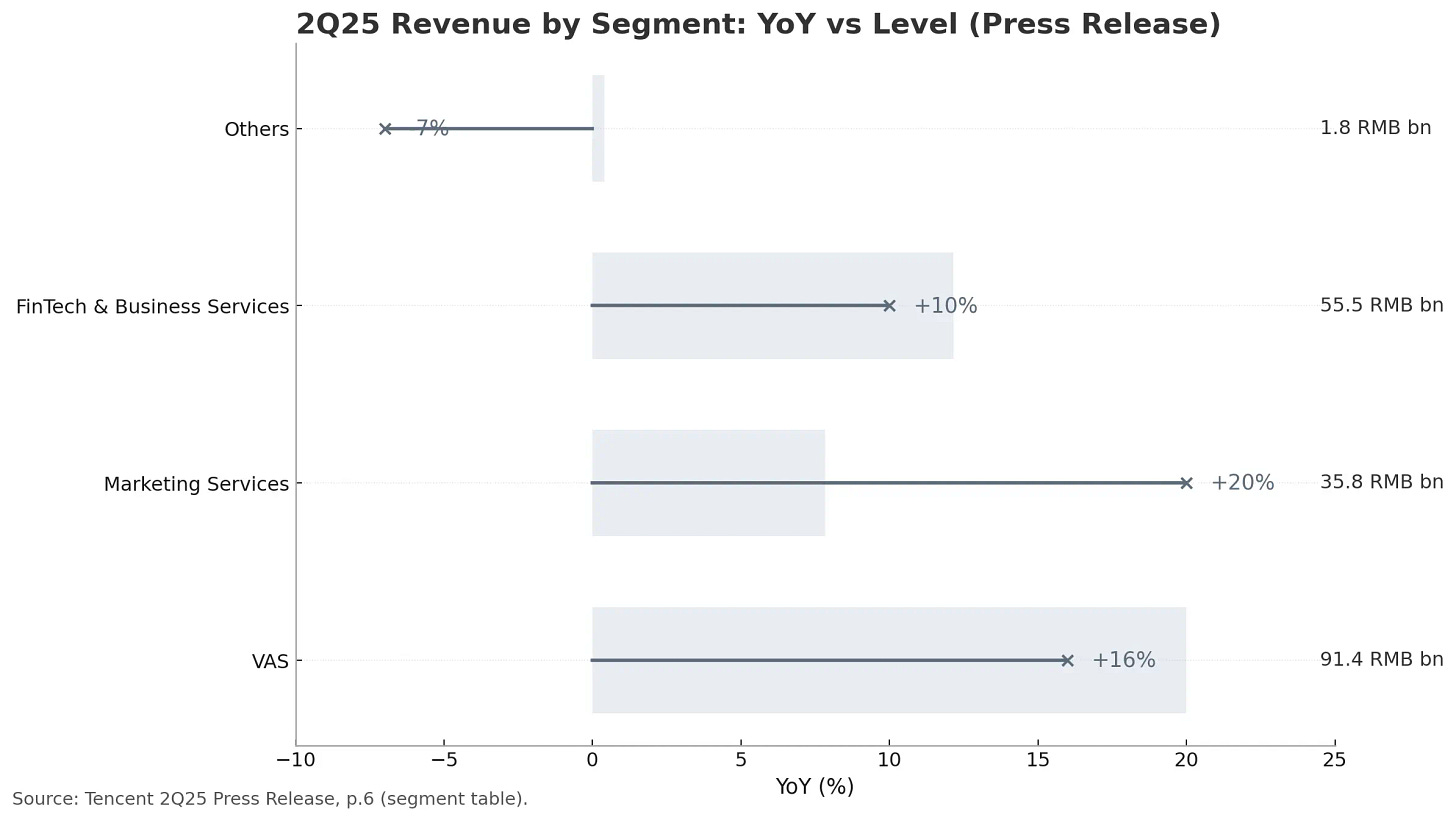

The Advertising Revelation

The most compelling evidence lies in Tencent’s advertising business, which grew 20% year-over-year to RMB 35.8 billion. But the growth mechanism matters more than the number itself. According to management, revenue increases came primarily from “single-impression revenue improvements”—meaning AI didn’t just deliver more ads, it delivered better ads.

The technical details reveal the sophistication of Tencent’s approach. Their AI systems now optimize across the entire commercial funnel: creative generation, audience targeting, placement optimization, and conversion tracking. Video Accounts and Mini Program ads each grew approximately 50%, while WeChat Search ads surged ~60%, driven by large language models that better understand commercial intent behind search queries.

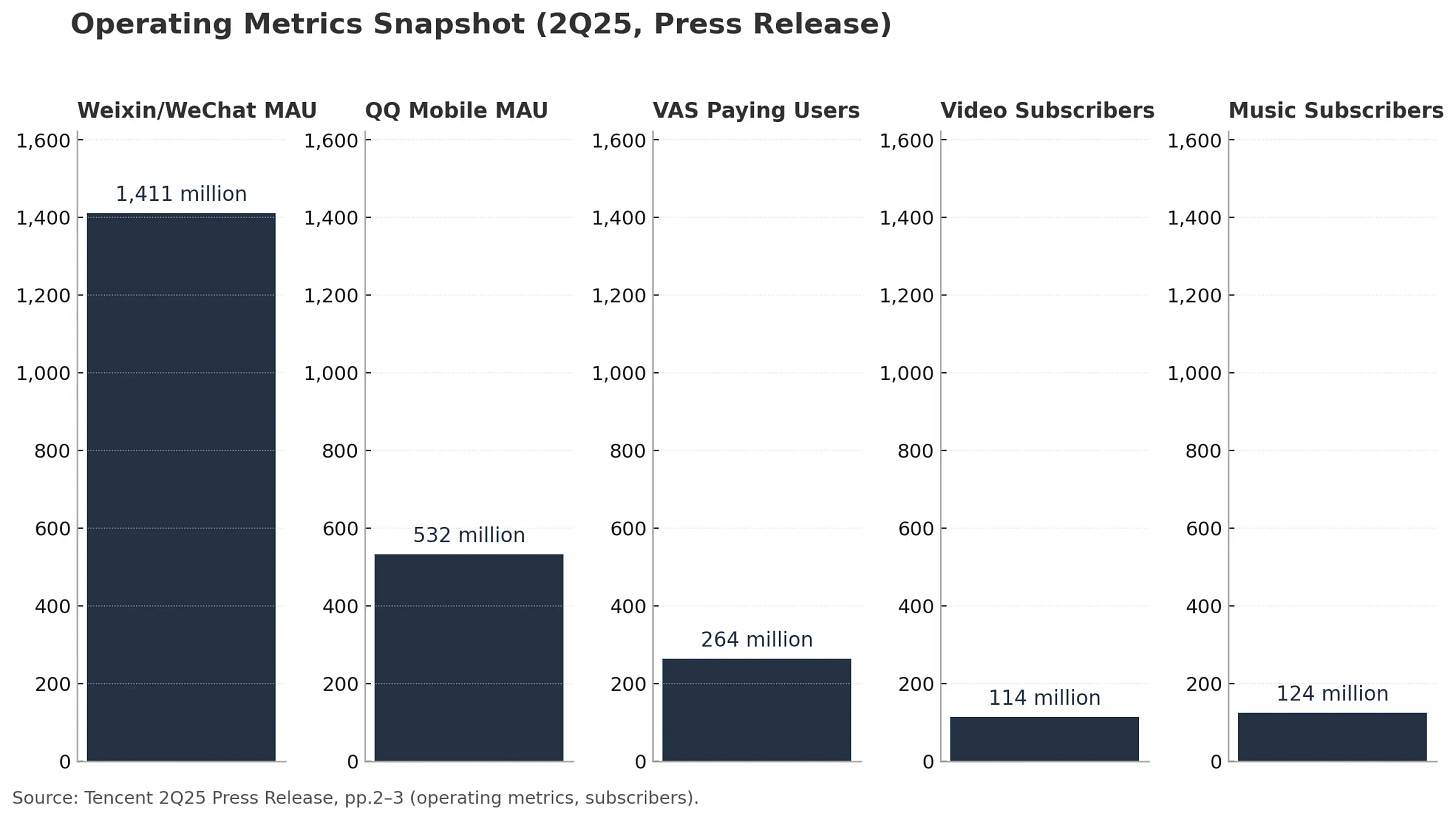

This isn’t the broad-brush AI application that Western platforms often discuss. It’s systematic integration across WeChat’s 1.41 billion monthly active users, where AI improvements compound through network effects. When AI helps a Mini Program convert better, it benefits the advertiser, the platform, and indirectly all other advertisers by proving the channel’s effectiveness.

Consider the strategic implications. While Google and Meta face increasing iOS privacy restrictions and cookie deprecation, Tencent operates within WeChat’s closed ecosystem where first-party data flows freely. AI models trained on this integrated commerce data—spanning social interactions, gaming behavior, payment patterns, and purchase history—can predict commercial intent with precision impossible on Western platforms.

The margin story reinforces this advantage. Advertising gross margins reached historic highs, reflecting not just pricing power but operational efficiency. AI-driven targeting reduces wasted impressions while improving conversion rates—a double benefit that flows directly to profitability.