China's AI Duopoly: Two Strategic Playbooks

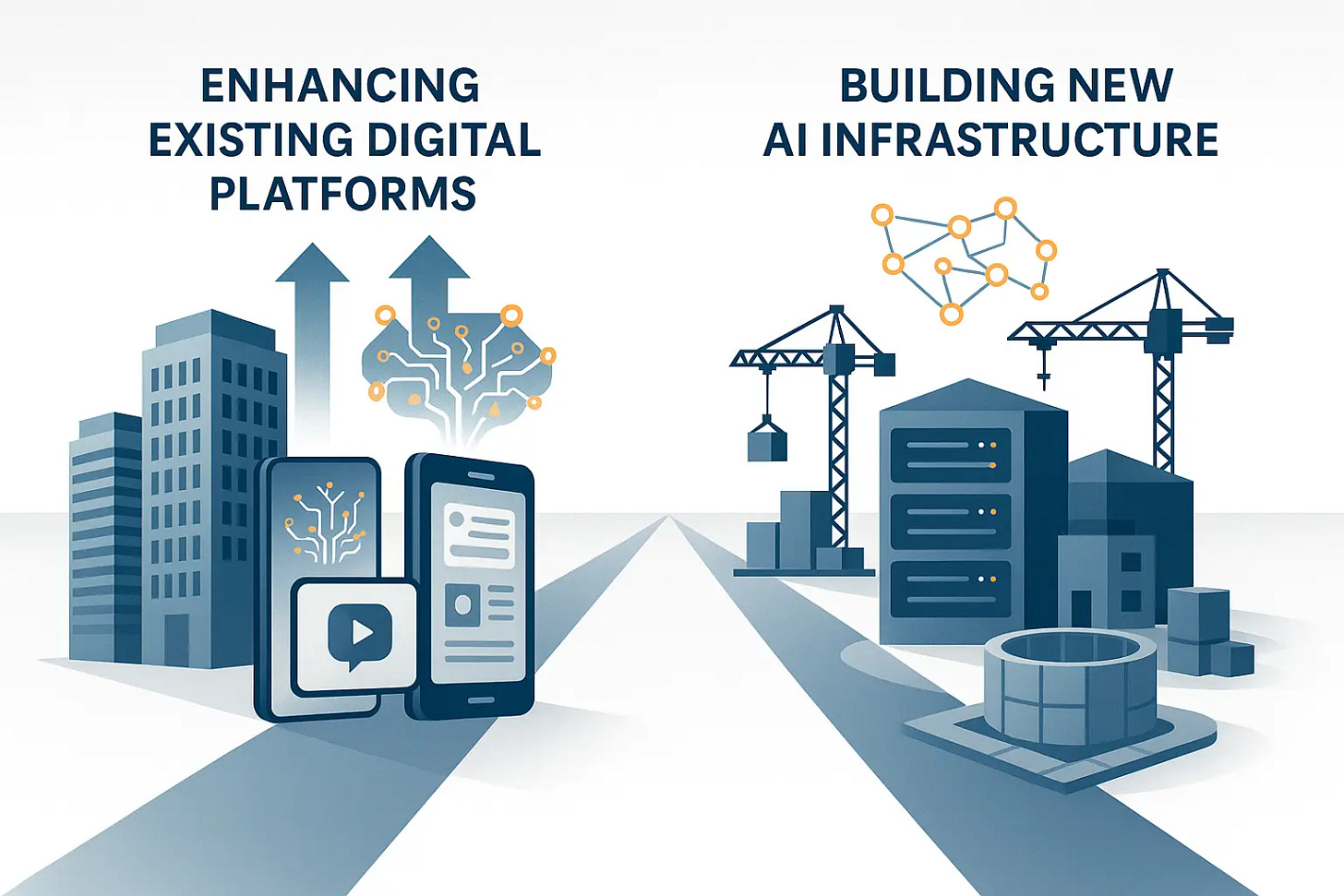

China’s two AI giants are playing radically different games. Tencent bets on enhancement, Alibaba on reconstruction. Which path defines the future?

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

When Tencent reported a 119% surge in capital expenditures while simultaneously showing immediate AI-driven revenue growth, and Alibaba reaffirmed its commitment to a 380 billion yuan three-year AI infrastructure investment despite posting negative free cash flow, they weren’t just reporting quarterly results—they were revealing two fundamentally different philosophies about how to navigate the AI transformation. These contrasting approaches offer a window into understanding not just Chinese tech evolution, but the broader strategic choices facing any organization in the AI era.

The divergence is instructive. Tencent’s AI investments are generating measurable returns across its ecosystem of games, social platforms, and advertising systems—with marketing services revenue growing 20% to 35.8 billion yuan. Meanwhile, Alibaba continues executing its plan to become foundational infrastructure for an AI-native world, accepting short-term profitability pressure in pursuit of long-term positioning. This isn’t merely about different risk tolerances—it represents two distinct theories of how AI will reshape entire industries.

The Tale of Two AI Strategies

Tencent: The Art of AI-Enabled Evolution

Tencent’s approach embodies what we might call “enhancement maximization”—using AI to make already dominant businesses exponentially more powerful. The company’s strategy is methodical and immediately profitable, reflecting a deep understanding of how to extract value from existing assets in the AI age.

The numbers demonstrate disciplined innovation. Tencent’s capital expenditures surged 119% to 19.1 billion yuan in Q2, with this investment showing measurable returns. The company’s WeChat search marketing revenue grew approximately 60% year-over-year, driven by large language models that better understand user intent and commercial opportunities. This represents systematic improvement in how digital advertising creates value.

Perhaps most revealing is Tencent’s internal resource allocation philosophy. The company has implemented what sources describe as an “unlimited resources” policy for AI projects that demonstrate business potential, providing unrestricted computing power and personnel support. This isn’t venture capital-style speculation; it’s strategic amplification of proven business models through AI integration.

The company’s Hunyuan model family demonstrates this focused approach. Rather than competing directly in the general-purpose AI race, Tencent has achieved notable results in specialized domains—ranking first on Hugging Face’s 3D generation leaderboard with over 2.3 million community downloads. This specialization strategy suggests that in a world of increasingly capable general-purpose AI, sustainable competitive advantage may require depth rather than breadth.

Alibaba: The Infrastructure Gambit

Alibaba’s strategy represents a reconstruction of the technology stack for an AI-first world. Where Tencent enhances existing capabilities, Alibaba is building new foundations.

The scale of this commitment is substantial. The company’s 380 billion yuan three-year investment plan exceeds its total AI-related investments over the past decade. This reflects a belief that AI will create new categories of economic value rather than simply improving existing ones.

Alibaba’s Qwen model ecosystem demonstrates this infrastructure-first thinking. The company has embraced radical openness, with over 3 million downloads and 100,000 derivative models in the open-source community. This approach sacrifices short-term control for long-term ecosystem dominance, betting that setting industry standards matters more than proprietary advantages.

The company’s willingness to engage in an API pricing war—cutting prices by up to 97%—further illustrates this long-term thinking. While such moves compress margins and contribute to negative free cash flow, they accelerate adoption and create network effects that could prove decisive in establishing market position.

Most notably, Alibaba is extending beyond software into hardware, from its T-Head (平头哥)semiconductor division to the recently announced AI glasses. This vertical integration reflects a belief that AI requires new hardware paradigms, not just software improvements. The company’s cloud division revenue grew 26% to 33.4 billion yuan, demonstrating market validation of this infrastructure-first approach.

The Deeper Logic: Assets, Risks, and Theories of Change

These divergent strategies aren’t arbitrary—they reflect fundamentally different assessments of core assets, competitive risks, and theories of technological change.

Tencent’s asset-optimization logic stems from possessing what may be irreplaceable digital assets. WeChat’s 1.4 billion monthly active users constitute a social graph that cannot be replicated or disrupted by technological change. The relationships and behavioral patterns embedded in this network become more valuable, not less, when enhanced by AI capabilities. Gaming franchises like Honor of Kings similarly represent cultural and social assets that benefit from AI enhancement without facing existential AI-driven disruption.

This creates what we might term “enhancement inevitability”—AI will make these assets more valuable regardless of specific technological developments. Whether through better content creation, more sophisticated user matching, or improved monetization algorithms, Tencent’s core assets become stronger with AI integration.

Alibaba’s reconstruction imperative reflects a different competitive reality. Cloud computing, e-commerce infrastructure, and digital services face potential disruption from AI-native alternatives. If AI creates fundamentally new ways of organizing digital commerce or cloud services, incremental improvements to existing systems may prove insufficient.

Alibaba’s strategy reflects a sophisticated understanding of “technological discontinuity”—periods when existing advantages can become liabilities if the underlying technological paradigm shifts. The company is essentially betting that AI represents such a discontinuity, requiring completely new infrastructure rather than enhanced existing systems.

China Context: The Enabling Environment

Understanding these strategies requires grasping several uniquely Chinese factors that enable such divergent approaches to coexist and thrive.

Scale as a Strategic Asset: Both companies benefit from China’s market scale, but in different ways. Tencent leverages user scale to generate AI training data and validation scenarios. Alibaba uses market scale to justify infrastructure investments that might be difficult to support in smaller markets. The 1.4 billion user base provides sufficient demand to support multiple AI development approaches simultaneously.

Policy Environment and Strategic Constraints: China’s “New Infrastructure” policy framework and emphasis on “New Quality Productive Forces” provide explicit government backing for large-scale AI investments, but this support comes with implicit expectations and potential regulatory oversight. While this policy environment enables companies to pursue multi-year AI strategies with reduced uncertainty, it also creates dependencies on continued government prioritization of AI development. Both companies must navigate the balance between leveraging policy support and maintaining strategic autonomy, particularly as geopolitical tensions shape China’s technology development agenda.

The “Internal Circulation” Innovation Model: Facing external technology constraints, Chinese companies are developing relatively independent AI ecosystems. This environment actually favors diverse strategic approaches, as companies can pursue different paths without being forced into direct competition with established global platforms.

Framework Insights: Universal Patterns in AI Strategy

These Chinese cases illuminate broader patterns applicable across industries and geographies.

The Asset-Strategy Alignment Principle

The most crucial insight is that successful AI strategies must align with existing core assets rather than ignore them. Tencent’s success stems from asking “How does AI make our irreplaceable assets more valuable?” rather than “What new AI capabilities should we develop?”

This suggests a diagnostic framework for any organization:

Irreplaceable Assets: What do you possess that competitors cannot replicate?

Enhancement Potential: How might AI make these assets exponentially more valuable?

Disruption Risk: Could AI-native alternatives make your assets obsolete?

The Timeline-Risk Correlation Model

Alibaba and Tencent represent different positions on what we might call the “timeline-risk correlation spectrum.” Short-term, lower-risk strategies (Tencent’s approach) offer clearer return visibility but may miss transformational opportunities. Long-term, higher-risk strategies (Alibaba’s approach) offer greater potential rewards but require sustained execution and favorable market conditions.

The key insight is that both approaches can be rational depending on:

Asset vulnerability: How likely are your core assets to face AI-driven disruption?

Resource constraints: Can you afford extended investment periods without clear returns?

Market position: Are you defending dominance or seeking to establish it?

The Ecosystem Complementarity Effect

Perhaps most importantly, Tencent and Alibaba’s different approaches create positive-sum dynamics within the broader Chinese AI ecosystem. Tencent’s application-layer innovations provide market validation and user education for AI technologies. Alibaba’s infrastructure investments lower barriers for AI adoption across industries.

This suggests that healthy AI ecosystems may require multiple strategic approaches rather than convergence on a single model. Policymakers and industry analysts should evaluate AI development across entire ecosystems rather than focusing on individual company strategies.

Looking Forward: An Observatory Framework

These divergent Chinese approaches offer a valuable framework for observing global AI industry evolution.

Key Variables to Track:

Return Timeline Validation: Over the next 12–18 months, we’ll see whether Tencent’s short-cycle AI investments continue generating clear returns while Alibaba’s long-cycle investments begin showing market traction. Notably, Alibaba’s AI-related products have already achieved triple-digit growth for eight consecutive quarters, suggesting sustained momentum according to multiple Chinese financial reports.

Technology Standard Setting: The competition between Hunyuan’s specialized excellence and Qwen’s open ecosystem approach will influence how AI capabilities develop and spread.

International Applicability: Monitor whether other markets see similar strategic bifurcation or if local conditions favor one approach over another.

Resource Efficiency: Observe whether Alibaba’s massive capital deployment creates sustainable competitive advantages or if Tencent’s focused enhancements prove more capital-efficient.

Analytical Questions for Continued Observation:

When AI capabilities commoditize, will Tencent’s asset-based advantages prove more durable than Alibaba’s infrastructure investments?

How will global technology fragmentation affect the viability of each approach in international markets?

Will other Chinese tech companies converge on one of these models or develop entirely new approaches?

Implications for Global Technology Strategy

The Tencent-Alibaba contrast offers crucial lessons for understanding AI transformation beyond China’s borders.

For Technology Companies: The choice between enhancement and reconstruction isn’t just about risk tolerance—it’s about honest assessment of your core assets and their vulnerability to AI-driven disruption. Companies with irreplaceable network effects or content libraries might benefit from enhancement strategies, while those in infrastructure or services might need reconstruction approaches.

For Policymakers: Supporting diverse AI development paths may be more valuable than promoting single strategic directions. The Chinese experience suggests that ecosystem-level diversity in AI approaches creates more robust innovation environments.

For Analysts and Observers: Evaluating AI strategies requires understanding the interplay between existing assets, technological timelines, and competitive dynamics rather than simply measuring R&D spending or model performance metrics.

The AI transformation is revealing itself not as a single technological shift but as a complex reconfiguration of how digital assets create value. Tencent and Alibaba’s divergent approaches remind us that there may be multiple viable paths through this transformation—and that the most important strategic question isn’t “How do we do AI?” but rather “How does AI remake what we already do best?”

As these two companies continue developing their different approaches to the AI age, they’re providing the world with a real-time case study in strategic possibility. The lesson isn’t that one approach will prove superior, but that understanding your unique position in the AI transformation may be more important than following any single technological trend.

About Hello China Tech

I’m Poe Zhao, and I bridge the gap between China’s rapidly evolving tech ecosystem and the global community. Through Hello China Tech, I provide twice-weekly analysis that goes beyond headlines to examine the strategic implications of China’s technological advancement.

Found this useful?

→ Share this newsletter with colleagues who need to understand China’s tech impact

→ Subscribe for free to receive every analysis:

→ Follow the conversation on 𝕏 for daily updates and additional insights

Get in touch: Have questions about China’s tech sector or suggestions for future analysis? Reply to this email – I read every message.

While the framing is engaging, I disagree with calling it different paths, at least for Alibaba. In my view, Alibaba will ultimately pursue Tencent's path as well in using AI to optimise its own processes. For Alibaba at least, it can pursue both paths. It might only be a matter of priorities.