The Robot Wars: China’s Pragmatic Path vs America’s Moonshot

How imperfect machines winning in China’s market reveals a fundamental divergence in the global tech race.

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

In spring 2025, a curious scene unfolded in Beijing’s Yizhuang district. Twenty-one humanoid robots stumbled and swayed through what organisers billed as humanity’s first robotic marathon. The machines frequently required human intervention to complete the course — a clumsy display by any technical measure.

Yet within weeks, one participant, Songyan Dynamics, reportedly saw its valuation jump from Rmb500m to Rmb2bn, securing more than Rmb50m in new orders. This was no isolated incident. A robot boxing match later that year featuring Unitree’s G1 humanoids captivated millions of online viewers. Despite what leading Chinese AI researchers candidly admitted was “GPT-2 level” autonomy, the spectacle sparked a sales surge. During the subsequent 618 shopping festival, Unitree’s G1 robots had reportedly sold more than 1,000 units on JD.com.

For western observers steeped in Silicon Valley’s perfectionist ethos, this presents a jarring paradox: how can technically flawed products generate extraordinary commercial momentum?

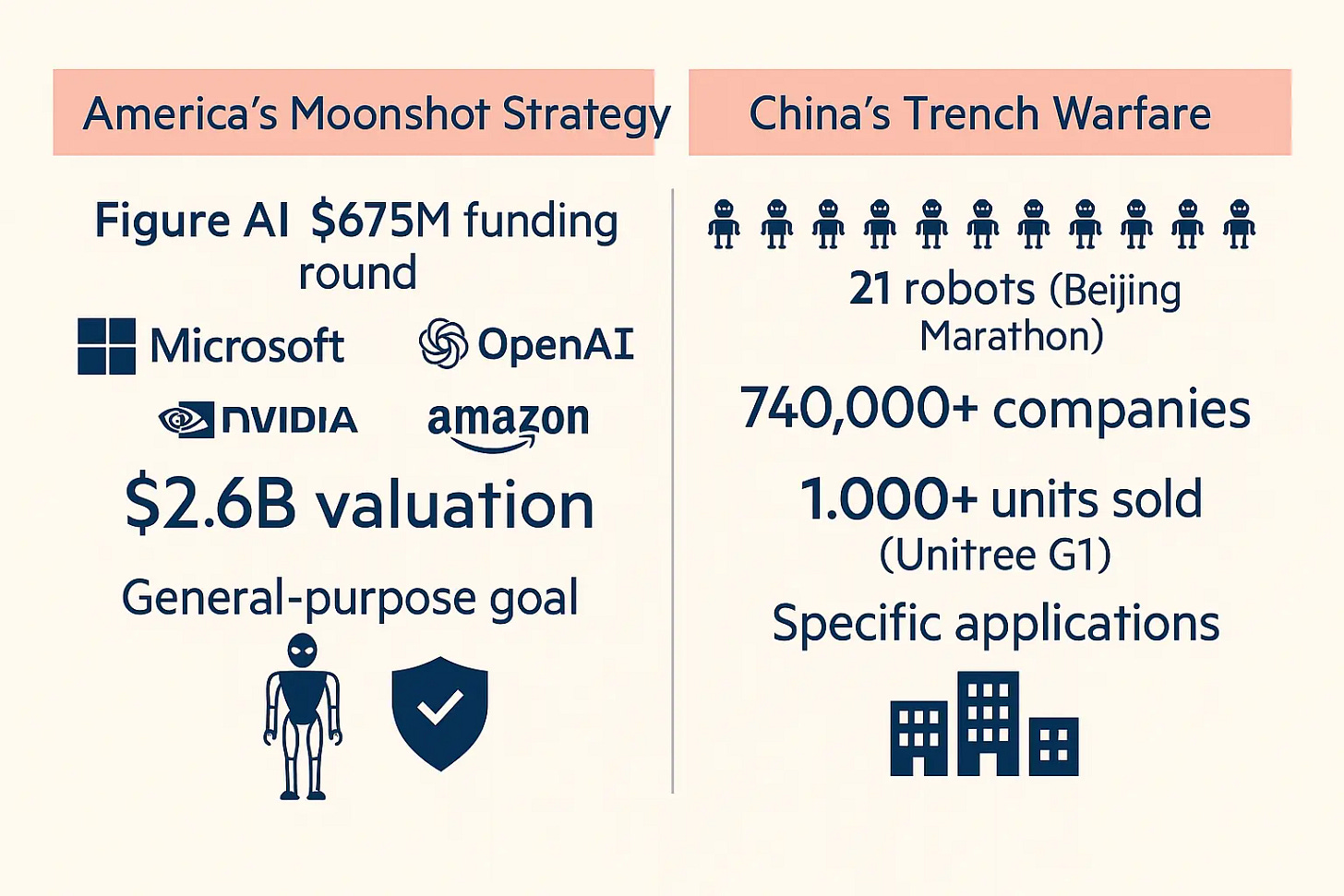

The answer reveals a fundamental strategic divergence between the world’s two largest economies as they race to define the future of robotics. While the US pursues a capital-intensive quest for technological supremacy, China wages pragmatic market warfare driven by industrial necessity. Understanding this split is critical for investors, executives and policymakers navigating the next phase of US-China tech rivalry.

America’s capital blitz

The American approach to robotics resembles a 21st-century Apollo programme — a coordinated effort to create a dominant new technology platform built on three pillars: strategic capital deployment, pursuit of general-purpose robots, and protective policy frameworks.

The funding rounds tell the story. When Figure AI secured $675m in early 2024, the investor roster read like a tech industry roll call: Microsoft, OpenAI, Nvidia and Amazon founder Jeff Bezos. This wasn’t venture capital betting on a single company — it was ecosystem warfare by Big Tech giants positioning for platform control.

The logic is clear. For Microsoft and OpenAI, robots represent the physical embodiment of their AI models. For Nvidia, they’re the ultimate market for next-generation chips. For Amazon, they’re the key to automating global logistics. The goal: create a new “Wintel”-style standard for embodied AI, where robots serve as hardware while their cloud and AI services provide the indispensable operating system.

This strategic capital fuels an audacious vision: the general-purpose humanoid robot. Companies like Figure, Tesla and Sanctuary AI aren’t targeting niche factory applications — they’re pursuing the holy grail of versatile machines operating anywhere from warehouses to homes. Figure plans home testing next year; Tesla’s Optimus targets consumer sales by 2026.

Washington provides protective cover. The White House has directed federal agencies to accelerate procurement of American-made AI systems. Proposed legislation like the No Adversarial AI Act explicitly seeks to block government use of AI systems from “adversary” nations — with China topping the list. This creates a walled garden for domestic champions, shielding them from low-cost competition while they pursue expensive R&D.

In essence, America is betting everything on an “iPhone moment” for robotics — a paradigm-shifting breakthrough that secures commanding heights of the 21st-century economy.

China’s market warfare

China’s robotics strategy operates by entirely different rules. Rather than pursuing moonshots, Chinese companies wage what might be called “market warfare” — methodically penetrating the domestic economy through three tactical approaches: leveraging imperfection, product simplification, and ecosystem consolidation.

The stumbling robots in Beijing represent tactical brilliance disguised as technical failure. In a capital market that has cooled significantly, forcing companies toward self-sustaining revenue models, these public spectacles serve as low-cost market penetration tools. A single well-publicised event generates more market awareness, investor interest and tangible orders than years of quiet lab work.

“Making subtractions for the scene” — as one industry insider described it — defines China’s product philosophy. Recognising the immense challenges of bipedal robots, many companies have retreated to quadruped “dogs” that offer greater stability and clearer applications in inspection and security. Even humanoid developers focus on narrow, controlled environments like exhibition halls and hotel lobbies where tasks are repetitive and predictable.

This constraint-driven innovation emerges from harsh market realities. With over 740,000 registered robotics companies competing domestically, firms must find the fastest path to product-market fit and profitability.

The third element involves strategic ecosystem consolidation. As US technology barriers rise, Chinese robotics firms increasingly partner with domestic tech giants, particularly Huawei. This represents more than business collaboration — it’s strategic necessity. Facing restrictions on American AI chips and software, companies are building robots powered by Huawei’s Ascend processors, running HarmonyOS, and controlled by Pangu large language models.

This vertical integration exemplifies China’s “dual circulation” strategy in action — building domestic alternatives to western technology ecosystems while reducing geopolitical vulnerabilities.

Investment implications

This strategic divergence demands new analytical frameworks for global stakeholders. Traditional Silicon Valley metrics may miss crucial signals in the Chinese market.

For investors, the greatest risk may be missing market timing rather than backing immature technology. China’s rapid iteration cycles mean commercial traction often proves more predictive than perfect prototypes. Investment analysis must weigh commercial momentum and ecosystem integration alongside technical milestones.

American “moonshot” valuations — Figure reportedly approaches $40bn in new funding — create high-beta opportunities but carry catastrophic downside if visions fail to materialise. Chinese firms’ focus on immediate revenue may produce more resilient, cash-flow positive businesses growing through market penetration rather than speculative leaps.

The most successful Chinese robotics company may not possess the best technology, but rather the deepest ecosystem integration. Investors should examine “connector” companies linking platforms like Huawei to specific industrial applications.

For executives, competition increasingly pits ecosystem against ecosystem rather than company against company. Competing in China means confronting the entire Huawei-led alliance. Western firms need strategies accounting for this bloc-based reality through hyper-specialisation, strategic partnerships, or market prioritisation.

China’s manufacturing advantage in Shenzhen and the Pearl River Delta enables rapid prototyping and cost-effective production currently impossible elsewhere. This represents both dependency risk and opportunity for western companies while creating potential chokepoints for China should tensions escalate.

The long game

Neither strategy guarantees success. America’s visionaries must eventually translate technical demonstrations into commercially viable products at market-acceptable prices — a challenge that has defeated many superior technologies throughout history.

China’s pragmatists face the opposite hurdle. Having secured market footholds solving simple problems, they must climb the value chain and innovate on core technologies — advanced AI, precision motors, sophisticated sensors — where they still lag.

The stumbling robot in Beijing’s marathon symbolises a system prioritising market entry over technical perfection, iteration over polish, collective survival over individual brilliance. Dismissing this approach as mere imitation misses a crucial signal.

Today’s clumsy machine, backed by the world’s largest manufacturing base and driven by relentless market pressure, could tomorrow be operating silently and efficiently in countless factories, warehouses and storefronts worldwide. That transformation — from spectacle to ubiquity — may define the winner in the global robotics race.

About Hello China Tech

I’m Poe Zhao, and I bridge the gap between China’s rapidly evolving tech ecosystem and the global community. Through Hello China Tech, I provide twice-weekly analysis that goes beyond headlines to examine the strategic implications of China’s technological advancement.

Found this useful?

→ Share this newsletter with colleagues who need to understand China’s tech impact

→ Subscribe for free to receive every analysis:

→ Follow the conversation on 𝕏 for daily updates and additional insights

Get in touch: Have questions about China’s tech sector or suggestions for future analysis? Reply to this email – I read every message.