The Great Chinese Robot Investment Paradox: $10 Billion Meets 17-Minute Room Service

Behind the hype, China's robotics boom is driven by demographic desperation, not technological readiness.

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

Limited-time offer: Upgrade to premium for 3x weekly strategic insights and market analysis. Regular pricing is $15/month, but subscribe before September 1st to lock in permanent discount pricing at just $10/month or $100/year.

A humanoid robot spent 17 minutes cleaning a hotel room at the World Humanoid Robot Games in Beijing last week. The task involved picking up nine pieces of trash–something a human housekeeper completes in under five minutes. Another robot took nearly five minutes just to grab three boxes of medicine in a pharmacy simulation. These weren’t prototype demonstrations or research experiments. These were China’s most advanced commercial robots, representing billions in investment and years of development, struggling with tasks that McDonald’s teenagers master on their first day.

The disconnect reveals something profound about China’s $10 billion robotics investment surge: the country’s biggest tech companies are pouring unprecedented resources into an industry whose basic value proposition remains unproven. While the numbers look impressive–63 investments across major platforms like JD, Alibaba, and Meituan over the past three years–the reality on the ground suggests that even China’s most sophisticated players are chasing a mirage of technological readiness that doesn’t yet exist.

This isn’t just a story about overhyped technology. It’s about the fundamental challenge of turning artificial intelligence breakthroughs into economic value, and why the companies with the deepest pockets and strongest deployment platforms are discovering that robot integration is far harder than robot building.

The Desperation Behind the Investment Surge

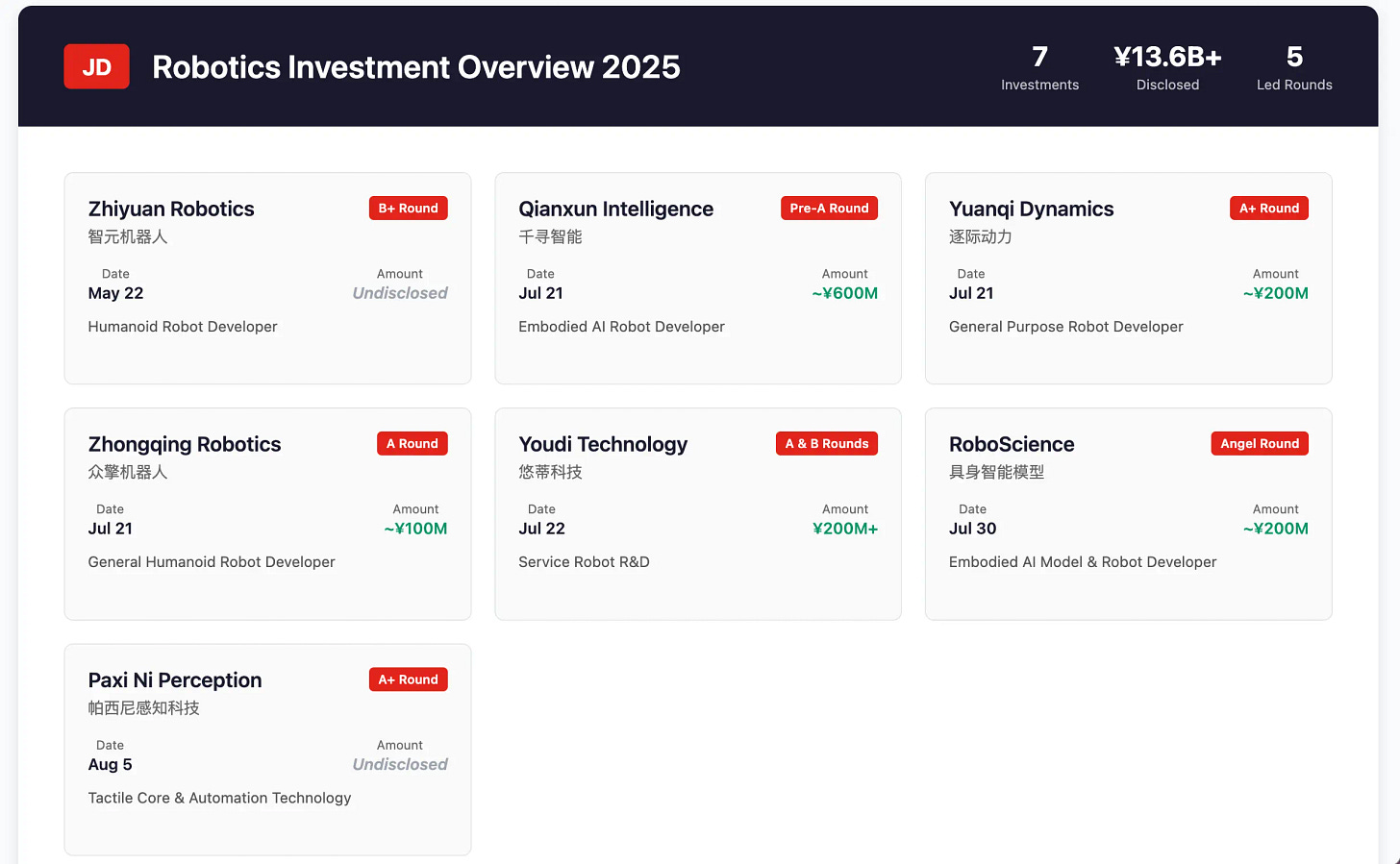

JD’s robotics investment spree this year tells a story that most observers are missing. Since May, the e-commerce giant has completed six robotics deals, including leading rounds for companies like Paxini Robotics and committing over $1 billion in resources through their “Intelligent Robot Industry Acceleration Plan.” On the surface, this looks like confidence. Dig deeper, and you’ll find something more urgent: JD is actually the latecomer desperately trying to catch up.

The investment timeline reveals the real dynamic. Alibaba started investing in robotics companies like Yigongli Intelligent (smart car wash robots) back in 2018. Meituan had already backed Pudu Robotics in 2020, securing early positions in service robots that now populate restaurants across China. Tencent placed bets on Ubtech as early as the company’s formative years. By contrast, JD’s seven total robotics investments represent the fewest among major Chinese tech platforms–and they’re all happening at premium valuations as the market heats up.

Consider what this pattern actually signals. JD operates China’s largest self-owned logistics network, with thousands of warehouses and millions of daily deliveries. If anyone should understand the practical value of robotics automation, it’s JD. Yet they waited until 2025 to make serious moves, and when they did, they had to pay leading-round premiums to secure partnerships that competitors had locked up years earlier at lower cost.

The urgency becomes clearer when you examine China’s demographic trajectory. The country’s working-age population peaked in 2014 and has been declining since. Labor costs in tier-one cities have tripled over the past decade. For companies like JD that depend on massive human workforces for fulfillment operations, robotics isn’t just an efficiency play–it’s an existential necessity. They’re not investing because robots are ready; they’re investing because they can’t afford to wait for robots to be ready.

But here’s where the story gets more complex. Even with this demographic pressure and unlimited capital, JD’s chosen partners are struggling with basic tasks. Paxini’s 6D Hall array sensors and DexH1 dexterous hands represent cutting-edge technology, yet the robots still can’t reliably perform simple warehouse picking operations without extensive environmental modifications. The gap between investment thesis and operational reality is enormous.