China's Practical AI Play: The Case for Right-Sized Intelligence

How China’s application-first AI path turns policy into profit — while U.S. giants still bet on AGI moonshots.

When 70 AI employees started handling government paperwork in Shenzhen’s Futian district this February, few outside China paid attention. These weren’t flashy chatbots or theoretical breakthroughs–just software processing documents with 95%+ accuracy while cutting review times by 90%. Yet this quiet deployment, powered by DeepSeek’s 67B parameter model, represents something potentially more significant than the latest Silicon Valley AGI announcement.

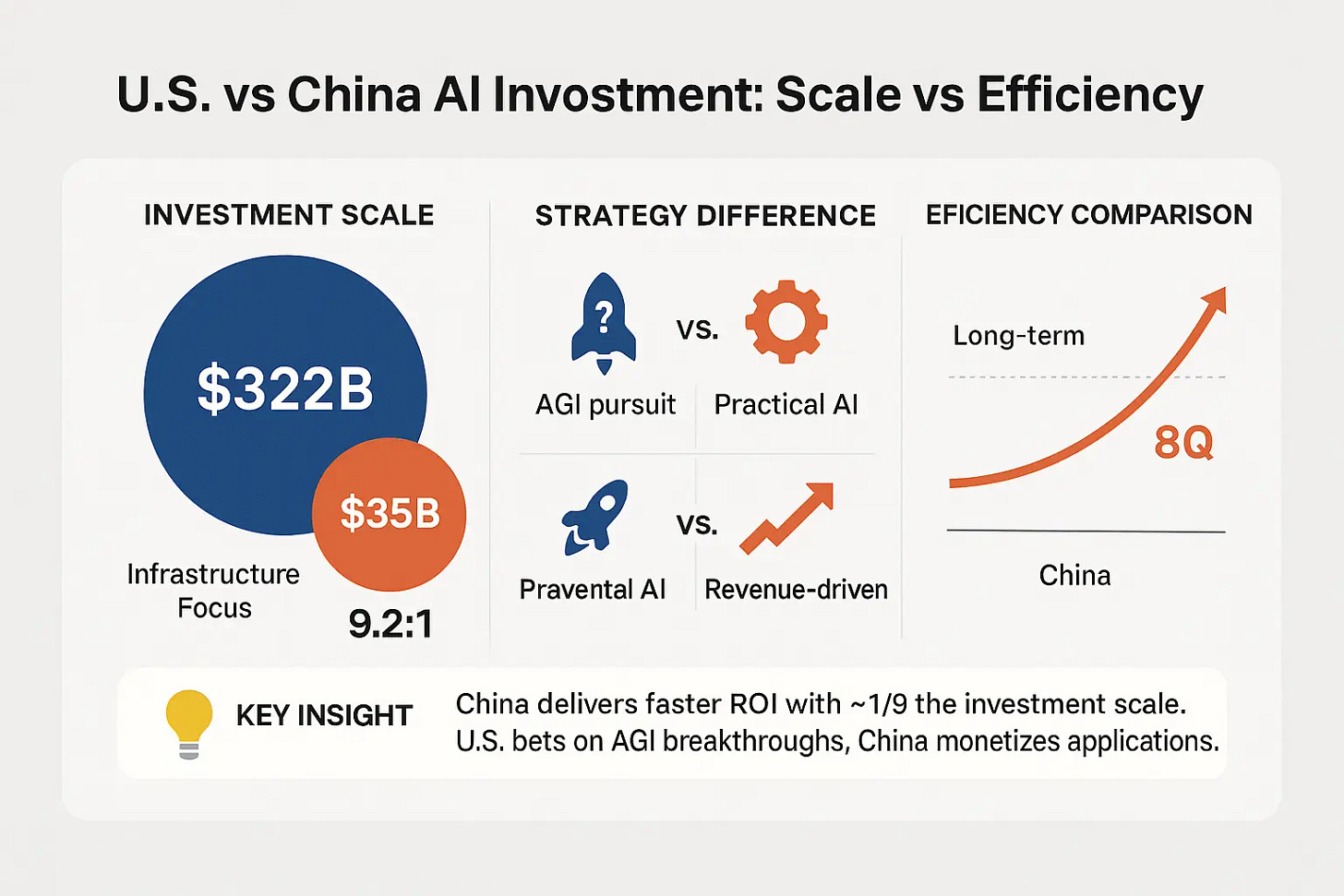

While American tech giants burn through hundreds of billions chasing artificial general intelligence, China is pursuing what might be called a “practical AI” strategy. The question isn’t which approach will win–both face significant uncertainties. Instead, it’s whether this divergence reveals fundamental differences in how the world’s two largest economies view AI’s commercial potential.

Two Capital Allocation Logics

The numbers illustrate starkly different approaches to AI development. U.S. tech companies are expected to spend $280–$364 billion in 2025 on AI infrastructure, supporting what amounts to a speculative bet on future AGI returns. Chinese companies, constrained partly by semiconductor restrictions, are focusing on smaller language models that deliver immediate applications.

This divergence stems from both necessity and choice. Export controls on advanced chips have made it difficult for Chinese companies to compete directly with American giants in training the largest models. But recent financial results suggest Chinese companies may have found advantages in this constraint.

Alibaba Cloud reported triple-digit AI revenue growth for eight consecutive quarters. Tencent’s FinTech & Business Services segment–including cloud–recorded RMB 55.5 billion in Q2 2025 revenue, not RMB 555 billion as some misreports suggested (Tencent earnings). Combined capital expenditure by China’s major tech companies jumped 168% year-over-year to RMB 61.6 billion in Q2 2025 (Kechuang Daily), with immediate revenue returns rather than speculative investment.

The contrast with U.S. companies is notable. While American firms show impressive AI investment levels, Chinese companies appear to be achieving faster returns on invested capital through targeted applications.

The Unit Economics of “Right-Sized” Intelligence

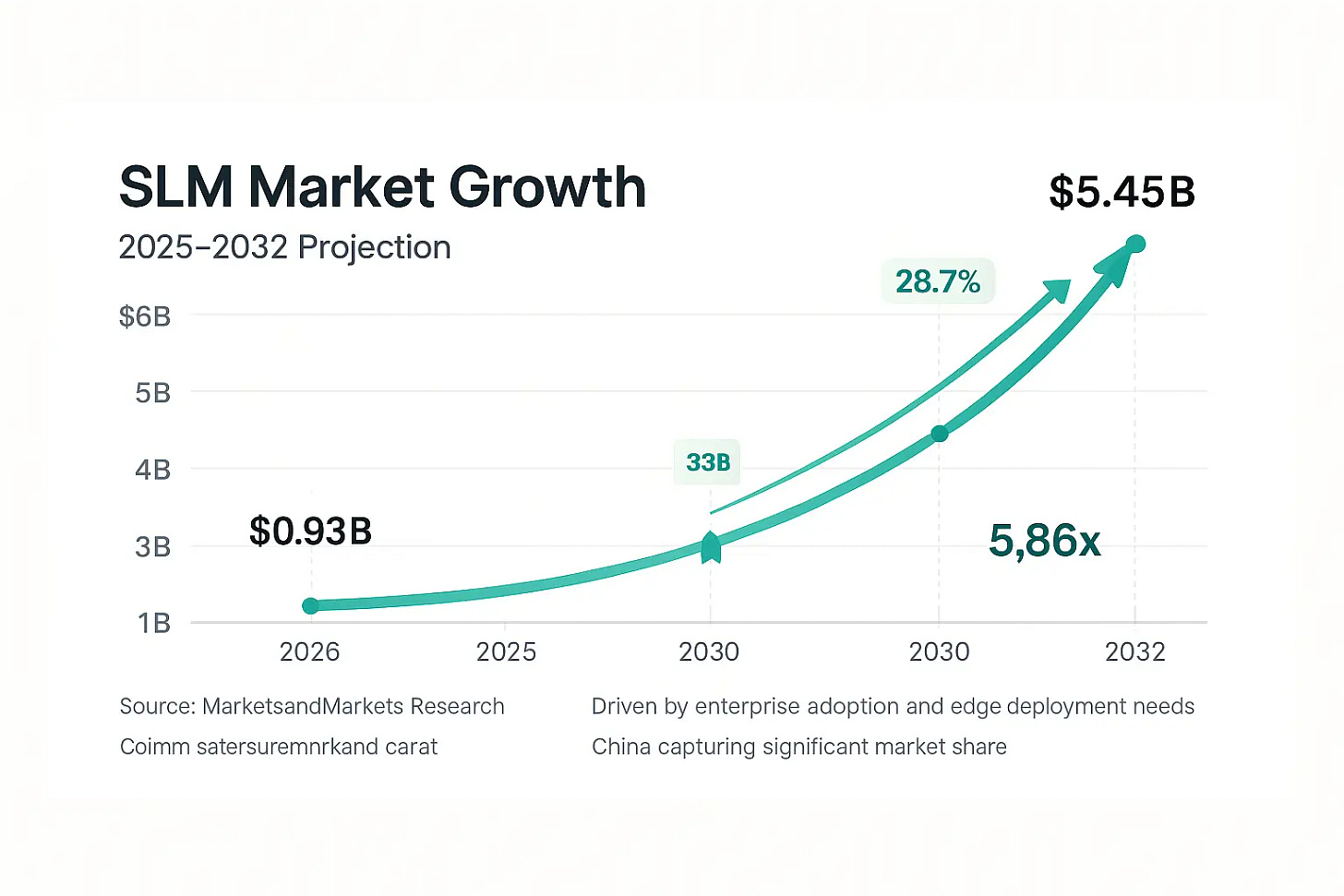

The small language model market, projected to grow from $0.93 billion in 2025 to $5.45 billion by 2032 (CAGR 28.7%), reflects demand for AI solutions that prioritize deployment efficiency over theoretical capabilities. Chinese companies are capturing disproportionate share through three factors: data sovereignty requirements favoring local deployment, cost sensitivity in manufacturing sectors, and infrastructure realities in smaller cities.

Consider the practical implications. A SaaS company executive described switching from cloud-based large models to a 4B parameter local model: “The large model performed well but had latency, cost, and data privacy issues. The smaller model deployed in hours, provided second-level response times, and protected privacy.” Similar stories are emerging across Chinese enterprises.

However, this approach has clear limitations. Small models lack the reasoning capabilities needed for complex, open-ended tasks. They require careful fine-tuning for specific use cases and may struggle with unusual requests outside their training scenarios. The question is whether these limitations matter more than the advantages in cost, speed, and privacy control.

Policy: From Slogan to Measurable Plans

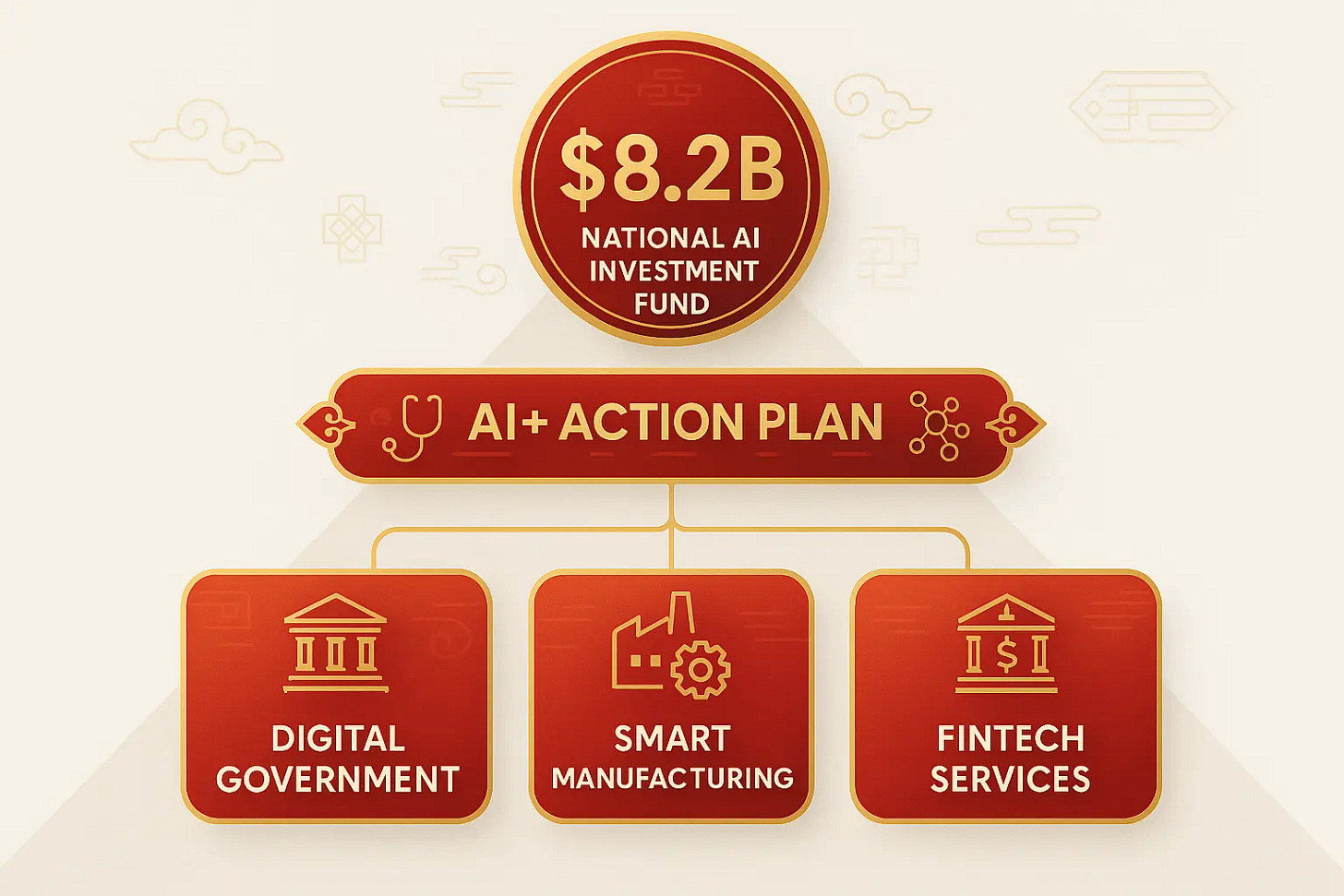

Xi Jinping’s emphasis on technology being “applications-oriented” has translated into concrete policy support. The central government launched an $8.2 billion national AI investment fund in January 2025, specifically targeting practical applications over basic research. In August 2025, Beijing followed up with an official “AI+ Action Plan”requiring local governments to produce measurable implementation schemes.

This policy framework creates advantages and risks. State backing accelerates deployment in government and state-owned enterprises, providing proof-of-concept opportunities that might not exist in purely market-driven systems. The “AI+” campaign mandates integration across sectors, creating demand that might otherwise develop more slowly.

Yet state direction also introduces constraints. Government priorities may not align with market opportunities. Emphasis on applications could come at the expense of fundamental research needed for longer-term competitiveness. The regulatory environment, while currently supportive, could shift if AI applications raise concerns about employment or social stability.

Next: Inside the technical playbook – from DeepSeek’s engineering shortcuts to Huawei’s chips, and what investors should really price in.