Beyond the App Store: Decoding China’s Full-Stack AI War Across Apps, Models, and Silicon

From Douyin’s blitz to Huawei’s silicon sovereignty, China’s AI race spans apps, models, and chips — and is diverging fast from the West.

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

📋 Quick note: I'm running a 2-minute reader survey to shape Hello China Tech's 2025 strategy. Your input matters!

Now, let's dive into today's analysis...

The battle for supremacy in China’s artificial intelligence sector has become a kind of three-body problem for global investors. Observing from afar, they are pulled by three distinct gravitational forces, each telling a different story about who is winning.

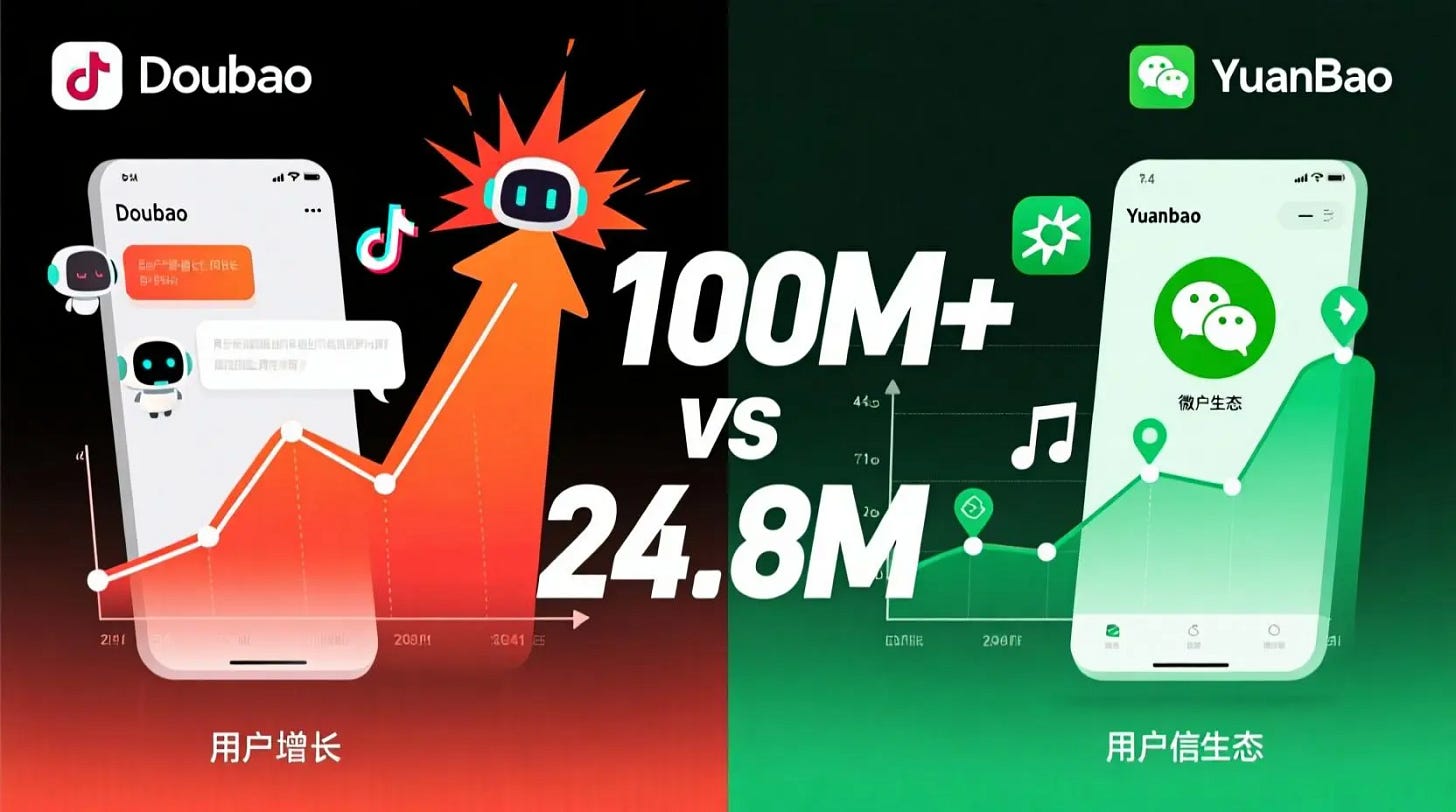

The first, and most visible, is the consumer app layer, where Bytedance’s Doubao appears to be in a dominant orbit — according to QuestMobile’s 2025 mid-year China Mobile Internet Value Ranking, in June 2025 Doubao ranked second in the “App User Scale Growth List” (MAU 100M level) with a staggering YoY growth rate of 410.69%, more than 100 million monthly active users ahead of Tencent-backed Yuanbao (24.80 million MAU)(QuestMobile report, Chinese).

The second is the developer ecosystem, a more chaotic system where a cluster of agile, open-source “insurgents” like Moonshot AI and Zhipu AIare exerting a powerful, and perhaps decisive, influence.

The third, and most fundamental, is the silicon layer, a geopolitical bedrock where national champions like Huawei are quietly rewriting the laws of computational physics for the entire domestic market.

To ask “who is winning?” is to ask the wrong question. A better question is, which of these three bodies will ultimately define the trajectory of the entire system? The answer is that they are inextricably linked.

The war for China’s AI future is not a single-front conflict but a full-stack competition, and understanding its dynamics requires descending through these layers, from the noise of the app store to the silent, strategic hum of the server farm.

Layer 1: The Illusion of Victory in the App Store

On the surface, Bytedance appears to have already achieved a decisive victory. Doubao’s massive user lead is a testament to the company’s ruthless execution.

By deeply integrating the AI chatbot into its primary traffic engine, Douyin, and dedicating a war-time budget to product iteration, Bytedance has done what it does best: brute-force a new user habit into existence.

Features like “one-sentence podcast generation”and advanced image editing are not just novelties; they are hooks designed to integrate AI into the daily content creation loop of hundreds of millions of users. It is a classic Bytedance blitzkrieg, and by all traditional metrics of user acquisition, it is working.

Tencent, by contrast, seems lethargic. Yuanbao’s feature set lags, its user numbers are an order of magnitude smaller, and according to multiple Chinese media reports, it is a lower-priority project compared to Tencent’s flagship gaming ventures.

But to interpret this as surrender is to miss the strategic calculus of an incumbent empire. Tencent is not trying to win the “chatbot” race; it is trying to avoid disrupting the multi-trillion-dollar social and commercial ecosystem that is WeChat.

This divergence reveals a fundamental philosophical divide. Bytedance, the perpetual insurgent, sees AI as a battering ram to conquer new territory. Tencent, the reigning emperor, sees AI as a new type of mortar to reinforce the walls of its existing fortress.

The recent integrations of Yuanbao with QQ Musicand Tencent Maps are the first signs of this fortification. Tencent’s bet is that while Bytedance wins the ephemeral battle for “fun” AI, the real long-term value lies in transactional and utility-based AI embedded deep within the WeChat ecosystem—payments, mini-programs, official accounts, and local services.

The 100-million-user gap, therefore, is not a scorecard of victory and defeat, but a measure of two vastly different strategic timelines and risk appetites.

Layer 2: The Open-Source Insurgency Reshaping the Core

While the giants fight their war of attrition, a more fundamental battle is raging one level down the stack. This is where China’s AI strategy diverges most sharply from the West.

While the U.S. market consolidates around a handful of powerful, closed-source proprietary models, China is experiencing a “Cambrian explosion” of highly competitive, aggressively open-sourcemodels. This is not a sideshow; it is rapidly becoming the main event.

The evidence from the past quarter is compelling. Startups like Moonshot AI (月之暗面) and Zhipu AI (智谱) are not simply building Chinese versions of Western technology. They are pushing the frontier.

Moonshot’s Kimi K2, a sophisticated one-trillion-parameter Mixture of Experts (MoE) model, rocketed to the top of global open-source leaderboards, outperforming many established players. Zhipu’s GLM-4.5 was purpose-built for AI agent applications, and Alibaba’s Qwen3-Coder is now in a dead heat with the world’s best proprietary coding models.

More fundamentally, these insurgents are weaponizing their business models. By pricing their APIs at a fraction—in some cases, as low as one-tenth of their Western counterparts—they are executing a strategic gambit to commoditize the model layer.

The goal is not immediate profit, but to capture the most valuable asset in the AI era: developer loyalty. They are creating an irresistible gravitational pull for a generation of Chinese developers and enterprises to build on domestic, open, and affordable foundations.

This insurgency is so potent that it has forced the hand of the giants. Bytedance’s decision to open-source its own agent development platform, Coze, was not a voluntary act of corporate largesse; it was a necessary defensive maneuver to prevent its developer ecosystem from being hollowed out by nimbler rivals.

For global investors, this is the most critical dynamic to grasp. The long-term value in China’s AI market may not accrue to the company with the most consumer users, but to the one that becomes the foundational “Android” or “Linux” for the entire developer ecosystem.

The “model insurgents” are making a credible play for that throne.

Layer 3: The Unseen Hand of the Silicon Foundation

Both the consumer app race and the developer insurgency rest upon a third, foundational layer: the silicon. And here, the rules are not being written by market forces alone, but by the geopolitical imperatives of Beijing.

The constant refrain of “nationally produced computing power” (全国产算力) at major industry conferences is the clearest possible signal of the government’s strategic intent: to build a technologically sovereign AI industry, insulated from American sanctions.

This is what makes the progress of a company like Huawei so profoundly important. Its official launch of the Ascend CloudMatrix 384 Supernode is more than just a new product release; it is a declaration of independence.

This system is designed to provide a viable, large-scale alternative to Nvidia’s GPUs for training frontier AI models. While the world’s AI development has been largely tethered to Nvidia’s CUDA architecture, a parallel ecosystem is rapidly maturing in China, built on Huawei’s Ascend.

This shift has deep strategic implications. Companies that align with this national strategy—adopting domestic hardware, optimizing their models for platforms like Ascend, and contributing to this parallel ecosystem—are not just making a technical choice; they are making a politically astute one.

They gain favor with regulators and secure their supply chains against geopolitical shocks. In this context, Huawei is transforming from a mere hardware vendor into a “geopolitical kingmaker.”

It is becoming the gatekeeper to the foundational resource of the AI economy, and access to its platform is becoming a prerequisite for any player with serious, long-term ambitions in China.

The ultimate winners of China’s AI war may not be those with the cleverest app or the most elegant algorithm, but those who build their house on this state-sanctioned stone foundation.

Conclusion: A New Framework for Investment

The three-body problem of China’s AI war cannot be solved by observing any single layer in isolation. A victory in the app store can be rendered moot by a shift in the underlying developer platform, and the entire system is subject to the gravitational pull of the domestic silicon mandate.

For international stakeholders, this requires a fundamental shift in analytical frameworks.

First, the metrics of success must be redefined.The obsession with Monthly Active Users (MAU) must be balanced with a rigorous tracking of developer-centric metrics: star counts on GitHub, downloads on Hugging Face, and adoption rates for domestic API platforms. These are the leading indicators of where the true technological value is accumulating.

Second, the competitive landscape must be viewed as a stack, not a line. The most important relationships are no longer just horizontal (Bytedance vs. Tencent) but vertical.

Will Doubao’s next version be powered by an in-house model or a cheaper, more efficient open-source alternative from Zhipu? Will Tencent’s enterprise clients build their AI agents on its proprietary platform or on Kimi’s open architecture? These are the new strategic questions.

Finally, geopolitical alignment is now a core due diligence item. Understanding a company’s relationship with the domestic hardware ecosystem—particularly its reliance on or adoption of Huawei’s Ascend—is no longer a secondary consideration. It is a primary indicator of its long-term viability and strategic positioning within China’s national ambitions.

The most pragmatic approach for investors is to diversify bets across the stack. The platform giants like Bytedance and Tencent represent integrated, lower-risk plays on mass-market adoption.

The model insurgents like Moonshot and Zhipu offer higher-risk, higher-reward exposure to the foundational technology layer. And the infrastructure providers, led by Huawei, represent a long-term bet on the geopolitical reality of technological sovereignty.

The race is far from over; it has simply become far more complex, and far more interesting.

📋 One last thing: If this analysis was helpful, please consider taking 2 minutes to share your thoughts in our reader survey. I'm planning some exciting content updates and your input will directly shape what we cover.

Thanks for reading, and I'll see you next time!