Two Paths to Commercial Scale in China’s Embodied AI

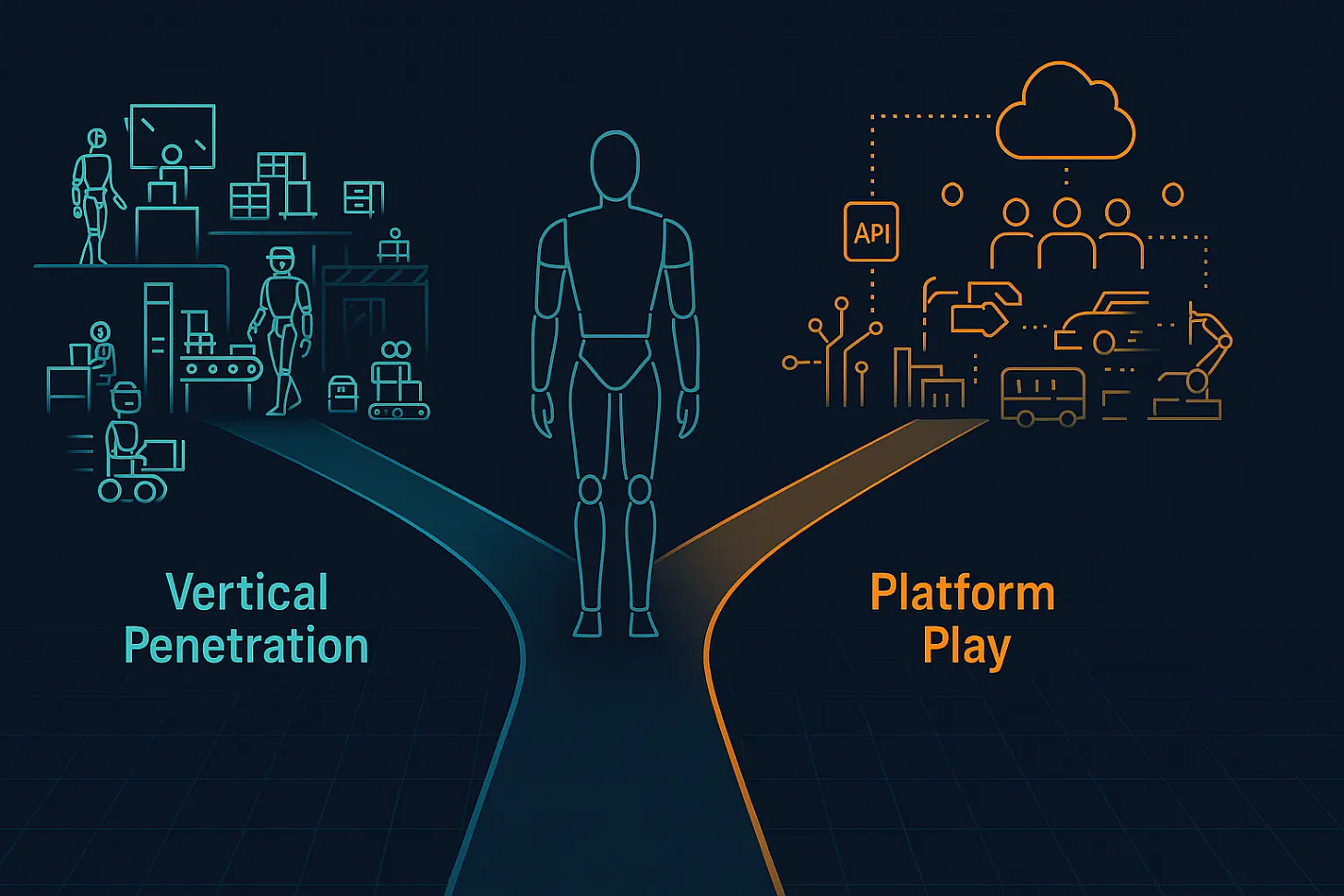

China’s humanoid race is converging on two strategies: Unitree’s vertical penetration and Zhiyuan’s platform play, with WAIC 2025 and the China Mobile tender as proof points.

Hello China Tech by Poe Zhao -- Essential insights into China's tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each week features in-depth free analysis plus premium insights for subscribers who need comprehensive coverage of China's strategic tech developments and their worldwide implications.

Limited-time offer: Upgrade to premium for 3x weekly strategic insights and market analysis. Regular pricing is $15/month, but subscribe before September 1st to lock in permanent discount pricing at just $10/month or $100/year.

The scene at Shanghai’s World Artificial Intelligence Conference this year told a compelling story about China’s embodied AI landscape. Visitors entering the exhibition hall were immediately greeted by humanoid robots engaged in sophisticated tasks—drumming, calligraphy, drink mixing, and even boxing matches that drew enthusiastic crowds. Yet beneath the spectacle lay a more profound transformation: China’s embodied AI sector was transitioning from demonstration-focused “showcasing” to commercially-driven delivery systems.

This shift crystallized around two companies that have emerged as the defining players in China’s humanoid robotics race: Unitree Robotics and Zhiyuan Robotics. Their competition represents more than a typical market rivalry—it embodies two fundamentally different strategic approaches to commercializing embodied AI, each offering valuable insights into how emerging technologies navigate the treacherous path from laboratory curiosity to industrial reality.

The Capital Construction of Dual Leadership

Understanding the Unitree-Zhiyuan dynamic requires first grasping how China’s investment ecosystem shapes technological competition. The broader robotics sector experienced explosive growth in 2024, with first-half financing reaching 27 billion RMB across 286 deals—a 138% year-over-year increase that signals both investor confidence and competitive intensity.

This capital surge reflects a sophisticated understanding among Chinese investors of how embodied AI differs from previous technology waves. Unlike software-centric innovations that can scale rapidly with minimal physical infrastructure, robotics requires sustained capital for hardware development, manufacturing scale-up, and iterative testing. The funding patterns around Unitree and Zhiyuan illuminate how different investor types perceive the sector’s strategic value.

Unitree, founded in 2016, represents the earlier wave of Chinese robotics entrepreneurship. Its ten funding rounds span venture capital (Sequoia China, Source Code Capital), industrial players (China Mobile, Geely, Tencent, ByteDance), and government funds. This diverse investor base reflects Unitree’s approach of building broad market appeal while maintaining commercial focus.

Zhiyuan’s trajectory tells a different story. Despite its later 2023 founding, it completed ten funding rounds by August 2024, driven initially by founder Peng Zhihui’s celebrity status as a former Huawei “genius youth” engineer. The company’s investor evolution—from early VC firms like Hillhouse and BlueRun to industrial giants like BYD and SAIC, then international players like LG Electronics—maps onto its ambitious global positioning strategy.

The contrasting investor compositions reveal deeper strategic philosophies. Unitree’s broad coalition suggests a “democratization” approach to robotics, making advanced capabilities accessible across multiple markets. Zhiyuan’s progression from tech-focused VCs to industrial conglomerates to international corporations reflects its “ecosystem builder” ambition—creating comprehensive platforms rather than standalone products.

Most significantly, both companies’ recent valuations—Unitree exceeding 12 billion RMB and Zhiyuan reaching 15 billion RMB—indicate that investors are betting not just on current capabilities but on platform potential. This suggests the market has evolved beyond viewing robotics as hardware manufacturing toward recognizing embodied AI as foundational infrastructure for multiple industries.

Convergent Pressures, Divergent Strategies

The China Mobile tender that brought these companies into direct competition illustrates how market forces push different strategic approaches toward similar outcomes. The 120 million RMB order—China’s largest humanoid robot procurement to date—saw Zhiyuan secure 78 million RMB for full-size humanoid robots while Unitree captured 46 million RMB for smaller units and accessories.

This convergence moment reveals several critical dynamics. First, the scale represents a qualitative shift from experimental purchases to operational deployment. China Mobile’s plan to deploy robots across provincial offices and major retail locations signals that humanoid robotics has crossed the threshold from novelty to utility.

More importantly, the tender exposed how different technical approaches must ultimately serve similar commercial requirements. Unitree’s hardware-first strategy, originally focused on quadruped robots, had to develop humanoid capabilities. Zhiyuan’s software-integrated approach, designed for comprehensive human-like functionality, had to prove specific task competence.

This convergence pattern reflects a broader principle in Chinese technology development: regardless of founding philosophy or technical approach, market pressures eventually force companies toward practical demonstration of value. The “交卷时刻” (exam moment) that industry observers predict for 2025 represents this accountability point where technical sophistication must translate into measurable commercial impact.

The convergence also highlights how China’s massive domestic market creates unique scaling opportunities. Unlike markets where robotics companies must immediately consider global expansion, Chinese firms can achieve substantial scale within domestic applications—industrial manufacturing, logistics, service sectors—before facing international competition. This domestic scale advantage allows for more diverse strategic experimentation.

The “Xiaomi vs. Huawei” Framework: Decoding Strategic DNA

The most illuminating way to understand the Unitree-Zhiyuan competition is through the lens of China’s successful consumer technology models. Unitree has adopted what can be characterized as a “Xiaomi approach”—emphasizing accessibility, aggressive pricing, and consumer mindshare. Zhiyuan follows a “Huawei model”—prioritizing comprehensive technical capabilities, ecosystem development, and premium positioning.

Unitree’s pricing strategy exemplifies the Xiaomi philosophy of democratizing advanced technology. When competing products typically cost 80,000–100,000 RMB, Unitree matched Pine Power’s disruptive 39,900 RMB price point within months. This wasn’t merely cost reduction but strategic repositioning—sacrificing some advanced features to achieve mass market accessibility.

The marketing approach reinforces this consumer-oriented strategy. Unitree founder Wang Xingxing has cultivated a public persona reminiscent of Lei Jun’s role at Xiaomi—a technology enthusiast making advanced capabilities accessible to ordinary users. The company’s presence on platforms like Xianyu (Alibaba’s second-hand marketplace) and collaboration with tech bloggers positions robotics as consumer electronics rather than industrial equipment.

Zhiyuan’s approach mirrors Huawei’s comprehensive ecosystem strategy. From the beginning, Zhiyuan articulated a three-layer architecture: hardware (robot bodies), software (world model AI systems), and ecosystem (open embodied AI platforms). This parallels Huawei’s cloud infrastructure approach, where hardware capabilities enable software platforms that support partner ecosystems.

The company’s partnership strategy particularly reflects Huawei-style ecosystem thinking. Collaborations with Deutsche Post DHL for logistics automation and Dongyang Optics for manufacturing integration aren’t simply customer relationships but ecosystem co-creation. Partners participate in investment, development, and deployment, creating mutual dependency that strengthens competitive positioning.

Most tellingly, Zhiyuan explicitly positions Tesla’s Optimus and Boston Dynamics’ Atlas as primary competitors, avoiding domestic price competition to establish premium technical credibility. This mirrors Huawei’s strategy of competing directly with global leaders rather than engaging in domestic market share battles.

The Automotive Convergence: Shared Infrastructure, Divergent Applications

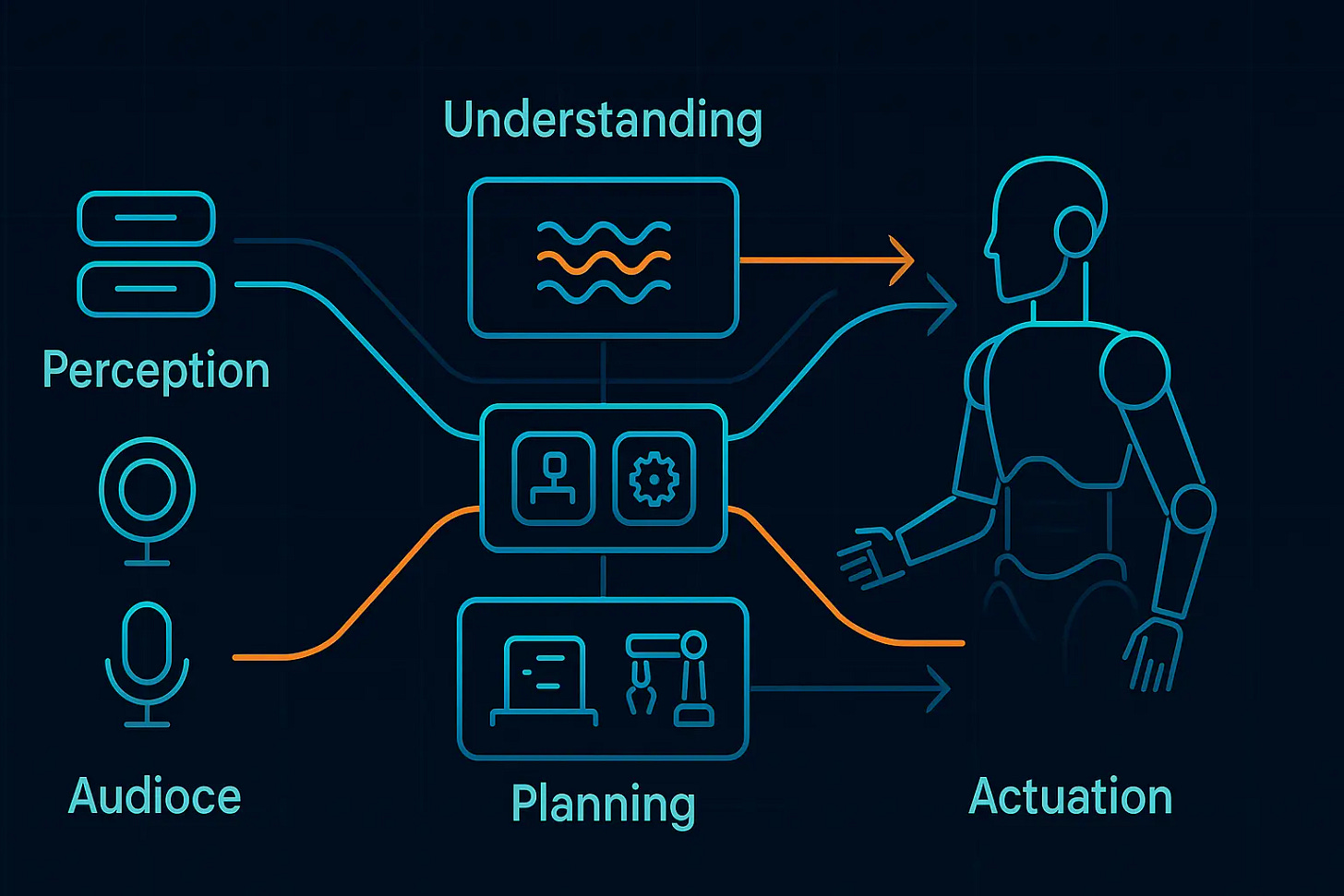

A crucial factor enabling both companies’ rapid development is the convergence between automotive and robotics technologies. The shared technological foundations—environmental perception, task understanding, motion planning—create opportunities for talent mobility and supply chain efficiency.

This convergence has made automotive companies, particularly electric vehicle manufacturers, a primary talent source for robotics companies. Former NIOemployees, for example, are prominently represented across multiple robotics startups, bringing experience in complex system integration and manufacturing scale.

The talent flow reflects deeper technological relationships. Current intelligent driving systems increasingly adopt VLA (Vision-Language-Action) + VLM (Vision Language Model) architectures similar to those used in embodied AI. This technical convergence reduces development risks and accelerates capability transfer between industries.

Supply chain sharing provides even more immediate benefits. The maturation of China’s electric vehicle supply chain—sensors, actuators, computing platforms, manufacturing processes—directly supports robotics development. This shared infrastructure explains how robotics companies can achieve rapid cost reduction and manufacturing scale.

However, the convergence also creates strategic complexity. As automotive companies develop increasingly sophisticated AI capabilities, they may choose to enter robotics directly rather than partnering with specialized companies. The boundary between “automotive AI” and “embodied AI” continues blurring, potentially reshaping competitive dynamics.

Commercial Pathways: Vertical Penetration vs. Horizontal Platform Building

The two companies’ approaches to commercial deployment reveal fundamental differences in how they conceptualize market development. These differences offer insights into broader questions about how AI-enabled technologies achieve commercial success.

Unitree’s approach emphasizes vertical penetration within specific use cases. By focusing on demonstrable capabilities in controlled environments—factory logistics, exhibition demonstrations, educational applications—the company builds credible reference cases that support horizontal expansion. This approach prioritizes immediate market validation over comprehensive capability development.

Zhiyuan pursues horizontal platform building, developing broad capabilities that can address multiple use cases simultaneously. The company’s partnerships across manufacturing, logistics, and service sectors aim to create a comprehensive ecosystem where robotics capabilities can be rapidly deployed across different applications.

Both approaches face distinct challenges. Vertical penetration risks creating specialized solutions that don’t scale across different contexts. Platform building risks developing capabilities that, while impressive, don’t solve specific customer problems effectively.

The reality of current deployment suggests that both approaches require significant customization for practical applications. Robotics capabilities in elderly care, for example, require extensive boundary definition—appropriate assistance levels, privacy considerations, safety protocols—that generic platforms cannot easily address.

This customization requirement suggests that commercial success may ultimately depend less on technical architecture and more on operational capabilities: customer relationship management, deployment support, maintenance systems, and continuous improvement processes.

Framework for Analysis: The Three-Stage Evolution Model

The Unitree-Zhiyuan competition offers a framework for understanding how embodied AI—and potentially other advanced technologies—navigate commercialization challenges. This evolution can be understood through three distinct stages:

Stage 1: Technical Validation During this period, companies focus on demonstrating that their approach can achieve required technical performance. Success metrics center on laboratory conditions and controlled demonstrations. Both Unitree and Zhiyuan have largely completed this stage, as evidenced by their sophisticated demonstrations at industry conferences.

Stage 2: Commercial Proof The current stage requires demonstrating that technical capabilities can deliver commercial value in real-world conditions. This involves supply chain optimization, cost management, and customer relationship development. The China Mobile tender represents a critical test of Stage 2 capabilities for both companies.

Stage 3: Platform Scaling Future success will depend on creating platforms that can efficiently address multiple use cases and markets. This requires ecosystem development, standard-setting influence, and international expansion capabilities.

This framework suggests that while technical differentiation drove early competition, commercial execution capabilities increasingly determine success. Companies that can efficiently navigate regulatory requirements, manage complex deployments, and maintain long-term customer relationships will likely emerge as eventual winners.

The framework also implies that the current “Xiaomi vs. Huawei” positioning may be temporary. As markets mature, successful companies often converge toward similar operational approaches regardless of founding philosophies.

Global Context and Future Implications

The Unitree-Zhiyuan competition unfolds against broader questions about China’s role in global technology development. Both companies operate in a sector where Chinese capabilities increasingly compete directly with international leaders rather than following established patterns.

This competitive positioning creates opportunities and challenges. On one hand, China’s manufacturing scale, diverse application scenarios, and rapid iteration culture provide advantages in robotics development. The speed with which both companies reduced costs and improved capabilities demonstrates these systemic advantages.

On the other hand, international expansion requires navigating regulatory differences, cultural preferences, and competitive responses from established players. Zhiyuan’s recent international investment from LG Electronics and Mirae Assetsuggests one approach to building global partnerships.

The broader implications extend beyond robotics to questions about how emerging technologies develop competitive advantages. The Chinese approach—emphasizing rapid iteration, cost optimization, and market-driven development—contrasts with approaches that prioritize technical perfection or regulatory compliance.

Observational Framework: What to Watch

Understanding the trajectory of China’s embodied AI sector requires tracking several key indicators that reveal the health and direction of competitive dynamics:

Commercial Deployment Metrics: Beyond announcement and demonstration, actual deployment numbers in real operational environments provide the most reliable indicator of genuine progress. Watch for quarterly deployment reports and customer retention rates.

Technical Architecture Convergence: Monitor whether VLA+VLM architectures become standard across the industry, or whether alternative approaches emerge. Technical standardization often precedes market consolidation.

International Competition Intensity: Track how Chinese companies perform when competing directly with Tesla, Boston Dynamics, and other international leaders. Success in international tenders and partnerships indicates global competitive viability.

Regulatory Framework Development: Watch for safety standards, operational guidelines, and ethical frameworks that will shape commercial deployment. Early movers in regulatory compliance often gain lasting advantages.

Ecosystem Partner Quality: Monitor the depth and strategic importance of partnership relationships. Surface-level collaborations differ significantly from integrated ecosystem development.

The Unitree-Zhiyuan competition ultimately represents more than two companies vying for market position. It embodies China’s broader approach to advanced technology development—leveraging domestic market scale, rapid iteration capabilities, and manufacturing excellence to compete globally in emerging categories.

For global observers, this competition offers insights into how China develops technological capabilities and competitive advantages. For industry participants, it provides a case study in how different strategic approaches navigate the complex path from technical innovation to commercial success.

The outcome will influence not only China’s robotics industry but broader questions about how emerging technologies achieve global impact. As the 2025 “exam moment” approaches, the lessons learned from this competition will extend far beyond robotics into the fundamental dynamics of technology innovation and commercialization.

About Hello China Tech

I'm Poe Zhao, and I bridge the gap between China's rapidly evolving tech ecosystem and the global community. Through Hello China Tech, I provide weekly free analysis plus premium insights (3x/week) that go beyond headlines to examine the strategic implications of China's technological advancement.

Found this valuable? → Share this newsletter with colleagues who need to understand China's tech impact

→ Subscribe for free to receive weekly analysis:

→ Upgrade to Premium ($15/month) for 3x weekly strategic insights and market analysis. Limited-time offer: Subscribe before September 1st at $10/month or $100/year to lock in permanent discount pricing.

→ Follow the conversation on 𝕏 for daily updates and additional insights

Get in touch: Have questions about China's tech sector or suggestions for future analysis? Reply to this email -- I read every message.