Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

Just a few months ago, the narrative surrounding China’s artificial intelligence landscape was one of explosive, seemingly unbridled growth. A Cambrian explosion of AI chatbots, each hailed as a potential domestic champion to rival OpenAI’s ChatGPT, flooded the market. Start-ups like Moonshot AI and DeepSeek, armed with powerful models and billions in funding, saw their user numbers skyrocket. The race for AI supremacy in the world’s largest internet market was on, and the chatbot was its chosen champion.

Today, the picture looks demonstrably different. According to recent market data from the South China Morning Post, the initial frenzy is subsiding. DeepSeek, an early frontrunner, saw its average monthly downloads plummet by a staggering 72% in the second quarter of 2025. Other prominent general-purpose chatbots, including Moonshot AI’s Kimi and Tencent’s Yuanbao, have experienced similar, sharp declines.

This cooling off, however, is not the sign of a bursting bubble or a loss of faith in AI. Instead, it marks the end of the technology’s novelty phase and the beginning of a far more significant, pragmatic chapter. The Chinese market, with its hundreds of millions of digitally-native users, is rapidly evolving past the simple fascination with “chatting with an AI.” It is now demanding utility. This fundamental shift from “AI as a toy” to “AI as a tool” is clearing the path for a new type of competitor.

In this context, ByteDance’s AI product, Doubao(known as Cici in some markets), presents a compelling case study. Its evolving strategy offers a glimpse into a potential playbook for the next phase of consumer AI—a phase less concerned with conversational prowess and more focused on building an indispensable platform for life and work.

The End of an Era: From Novelty Engagement to Utility Demand

The initial appeal of large language models (LLMs) to the public was their conversational ability. The magic of asking a question and receiving a human-like response was enough to attract millions of curious users. This was “Phase 1” of consumer AI adoption, where success was measured in downloads and monthly active users (MAUs).

However, novelty has a notoriously short shelf-life. Once the initial “wow” factor fades, a more critical question emerges in the user’s mind: “What can this actually do for me?” The data from China suggests the answer, for many generic chatbots, was “not enough.”

This decline in chatbot engagement is only half the story. The other, more telling half is the simultaneous, explosive rise of a new category: specialized, vertical AI applications. Work-focused tools like Tencent’s ima.copilot and 360 Wenku have seen their user bases surge by 190% and 135% respectively. AI-powered study assistants from edtech firms are also gaining significant traction.

The message from the market is unambiguous. Users are not abandoning AI; they are trading shallow, broad engagement for deep, narrow utility. They are moving from apps they chat with to apps they work with. It is in response to this evolving demand that ByteDance’s approach with Doubao warrants closer examination.

A Dual-Faced Strategy: The ‘AI Assistant’ and the ‘AI Workspace’

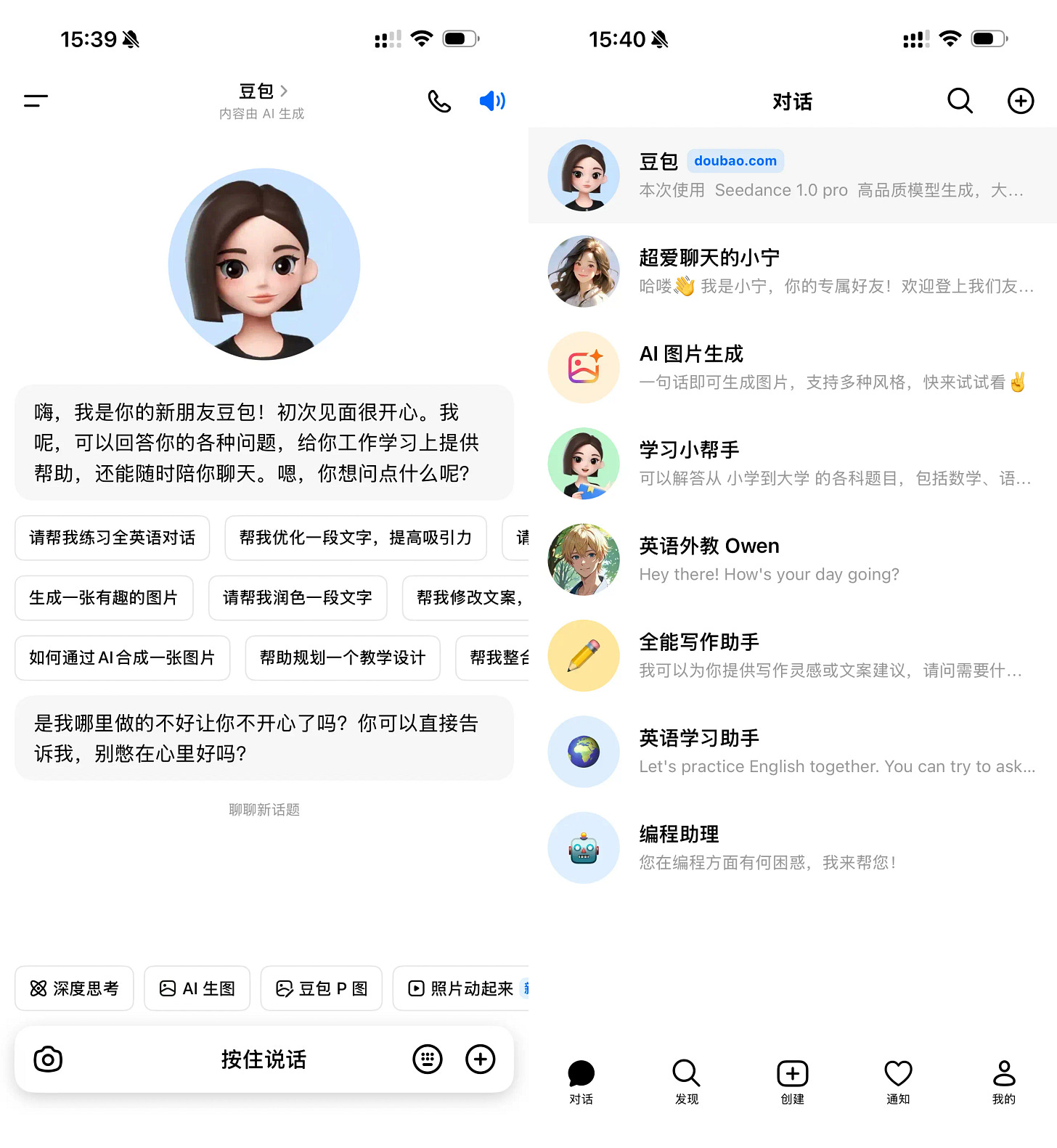

A key aspect of Doubao’s competitive strategy is its design. It is not a single, monolithic product. Instead, it embodies a calculated duality, engineered to present two distinct functional faces to the user depending on their context and device. It operates as both a personal AI Assistant and a professional AI Workspace.

The AI Assistant: A Companion on the Go (The Mobile Experience)

On a smartphone, Doubao is crafted to feel less like a sterile tool and more like a responsive companion. The interface prioritizes conversation, voice interaction, and light, contextual tasks.

This mobile-first persona is tailored for life in motion: helping a user identify an object through their camera, offering real-time advice, or engaging in casual conversation. The goal appears to be fostering a personal, habitual connection, making the AI a readily accessible resource for everyday queries and interactions.

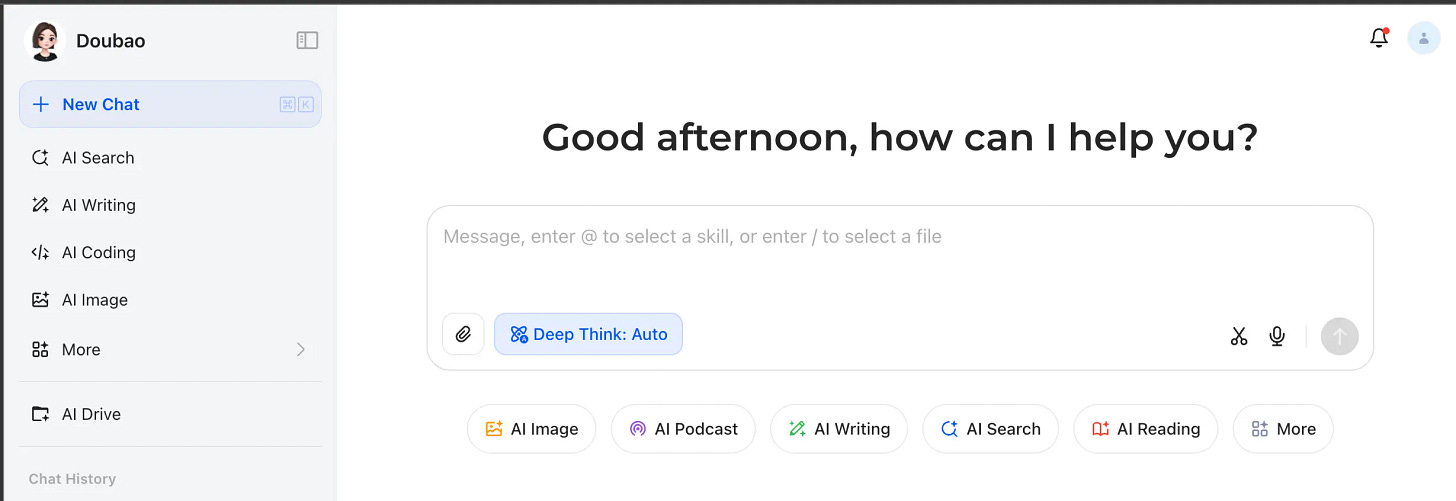

The AI Workspace: A Colleague at the Desk (The Desktop Experience)

Switch to a PC, and Doubao’s character shifts significantly. The playful, chat-centric mobile interface gives way to a productivity suite. Here, Doubao functions less as a companion and more as a collaborator for deep work. The desktop version is a hub for task completion and content creation, featuring an AI Cloud Drive, code generation tools, and advanced modules for generating and editing complex images. Users are guided towards task-oriented activities like writing reports, debugging code, or designing presentations.

This dual-track approach is noteworthy because it acknowledges that user intent is radically different on mobile versus desktop. By creating two tailored experiences under one unified brand, ByteDance aims to capture the user across multiple modes of their life, potentially building a comprehensive data profile that could enhance its AI’s capabilities over time.

The High Stakes of a Full-Stack Strategy

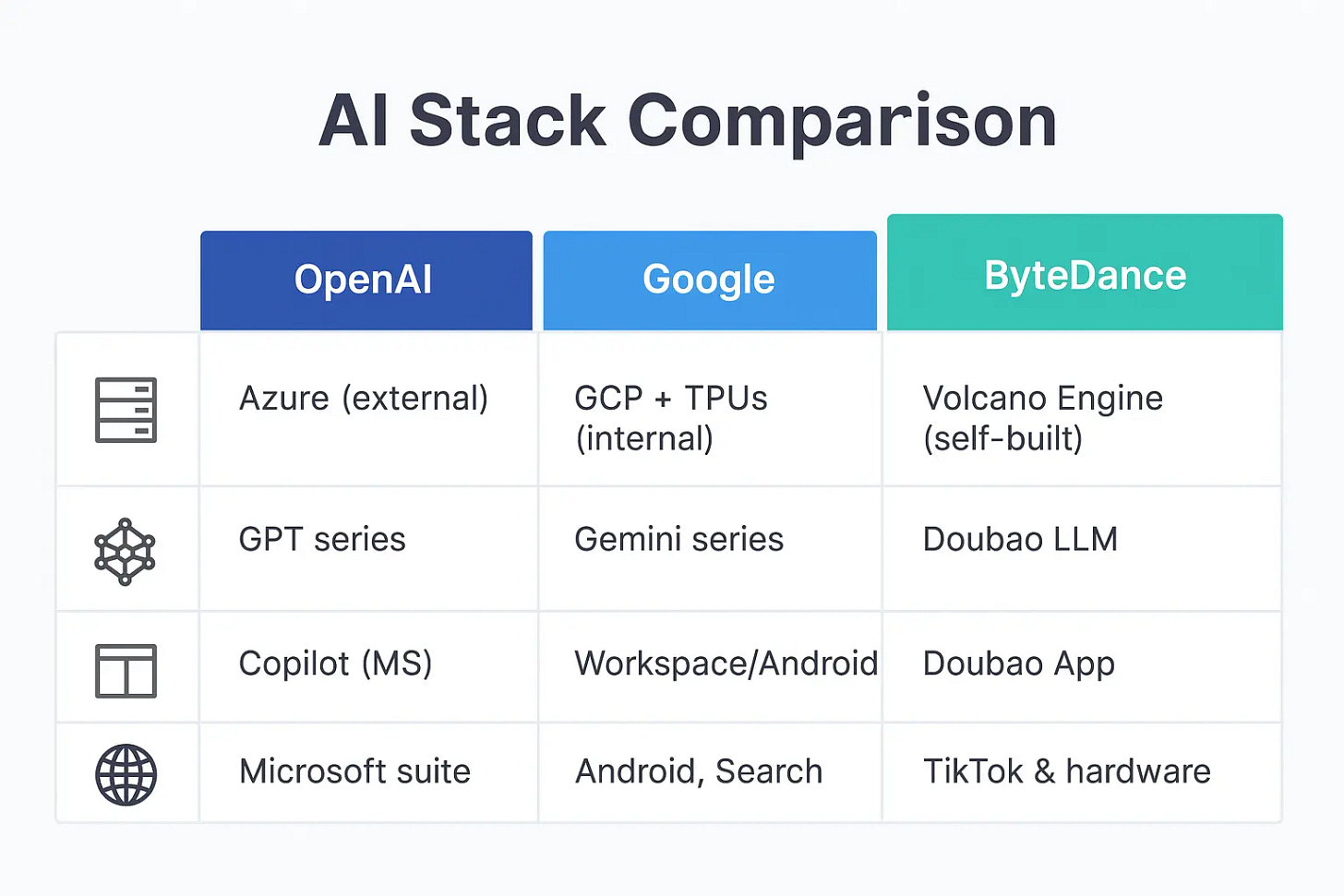

Beyond the application layer, ByteDance is pursuing an ambitious and costly full-stack strategy, seeking to control the key pillars of its AI ecosystem. This structure includes:

Infrastructure (Volcano Engine): ByteDance’s own cloud computing division, providing a foundation for cost and performance optimization.

Intelligence (Doubao LLM): Its in-house foundational model, which can be iterated upon using data from its vast user base.

Interface (The Doubao App): The “Assistant + Workspace” application, serving as the primary point of user interaction.

Integration & Distribution (TikTok/Douyin and Hardware): Leveraging TikTok for unparalleled distribution, with reported ambitions to develop AI-native hardware like smart glasses.

ByteDance’s vertically integrated model—spanning infrastructure (Volcano Engine), foundational models (Doubao LLM), interface (Doubao app), and distribution (TikTok, potential smart devices)—is among the most ambitious seen in the consumer AI space. In essence, ByteDance is building a closed-loop AI supply chain, where each layer reinforces the others in a self-sustaining cycle.

This approach mirrors Big Tech’s playbook, but with key distinctions. Unlike OpenAI, which relies on partners like Microsoft for both distribution and infrastructure, or Google, which leverages its cloud empire and in-house chips (TPUs), ByteDance is attempting full-stack control without historical advantages. This makes its play bolder, but fraught with operational risk.

Consider hardware: building AI-native devices like smart glasses demands expertise in optics, thermal engineering, energy efficiency, and consumer logistics—areas where even Meta and Apple have faced public setbacks. ByteDance is entering these domains while simultaneously scaling AI platforms and foundational models.

In seeking to own every layer—from chip to fingertip—ByteDance is wagering not just on AI success, but on becoming a full-spectrum platform owner in the next tech paradigm. Whether it can execute across such a sprawling frontier will determine if its AI ambition is revolutionary—or overreaching.

Furthermore, a full-stack strategy, especially one that includes hardware, is notoriously difficult to execute. It requires excellence across disparate fields, from silicon design to supply chain management and consumer marketing. Finally, a platform that aims to integrate so deeply into both the personal and professional lives of its users will inevitably attract significant regulatory scrutiny regarding data privacy, security, and market competition, both domestically and abroad.

Strategic Implications: A Playbook to Watch

Despite the challenges, the evolution of China’s AI market and Doubao’s strategic response offer important lessons for global observers.

For Investors: The metrics for evaluating consumer AI companies require recalibration. Simple MAUs for generic chatbots are becoming a less reliable indicator of long-term value. The focus should shift to utility, workflow integration, and the viability of a company’s ecosystem strategy. The path to monetization must be a central part of the analysis.

For Entrepreneurs: The window to compete by building a slightly better chatbot appears to be closing. The opportunity now lies in vertical dominance. Building an indispensable “AI copilot” for a specific community—architects, lawyers, scientists—and solving a deep, painful problem may be a more viable path than competing on a generalist front.

For Corporate Executives: The strategic challenge from AI is not just a new product, but the potential for ecosystem lock-in. A platform that successfully integrates into multiple facets of a user’s life could become a powerful gatekeeper. This underscores the importance of integrating AI deeply into one’s own core products and services to maintain a direct and valuable customer relationship.

Conclusion: An Unfolding Race

The cooling of the initial chatbot hype in China is not a setback for AI. It is a sign of a market that is maturing, demanding tangible value over novelty. Companies are now being tested not on the eloquence of their models, but on the utility of their applications.

In this new environment, ByteDance is making a formidable bid to define the next era of consumer AI. Its dual-purpose product strategy and its ambitious full-stack approach represent one of the most comprehensive attempts to build a truly integrated AI-native platform. However, the playbook is still being written, and the outcome is far from certain. Faced with immense execution challenges, an unclear path to profitability, and inevitable regulatory hurdles, the race for AI dominance remains wide open. The strategies unfolding in China, with all their complexities and risks, serve as a critical and instructive preview of the global competition to come.

About Hello China Tech

I’m Poe Zhao, and I bridge the gap between China’s rapidly evolving tech ecosystem and the global community. Through Hello China Tech, I provide twice-weekly analysis that goes beyond headlines to examine the strategic implications of China’s technological advancement.

Found this useful?

→ Share this newsletter with colleagues who need to understand China’s tech impact

→ Subscribe for free to receive every analysis:

→ Follow the conversation on 𝕏 for daily updates and additional insights

Get in touch: Have questions about China’s tech sector or suggestions for future analysis? Reply to this email – I read every message.

Alibaba's Quark product is similar in functionality and according to data I saw last week it is more used than Doubao, in fact the second most used "AI" application after ChatGPT.